De.Fi: The Best Alternative to Zapper

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

If you’ve heard of EOS, it’s probably because 2021 isn’t the first crypto cycle you have experienced.

Back in 2018, EOS became famous because it raised over $4 billion in the biggest ICO of all time. Since then, the project’s trajectory has not been the path you might have expected from the massive fundraising. However, it did result in a blockchain network with a unique governance model called Delegated-Proof-of-Stake (DPoS).

Now, there are lending opportunities available on EOS and this guide has been written to explain what those are, as well as to give you a brief explanation of how the EOS network differs from others.

What is EOS?

EOS infrastructure

EOS Permission Management System

The EOS ecosystem

EOS wallets

Lending and Liquidity Provision on EOS

Token Swap

Lending on Pizza.finance

Should I use EOS?

The EOS network was not launched by its original creators. Instead, the software was distributed across the community by block.one, with proactive teams cooperating to create the appropriate infrastructure to launch the EOS network.

EOS can be considered a semi-decentralized network since the block-producing activities are performed by a limited set of 21 supernodes, referred to as block producers (BPs). Initially, they followed a specific set of guidelines called the Constitution, which prevented them from abusing the network.

The EOS Core Arbitration Forum (ECAF) also played a role in regulating it but then got into some questionable situations where it had to suspend accounts and reverse transactions. Eventually, this resulted in the ECAF being discontinued.

EOS’s network infrastructure has been debated across the blockchain community because it favors performance benefits over complete decentralization. On the positive side, the network can achieve high transaction throughput of between 4,000–5,000 transactions per second, provide free transactions for network participants and establish a foundation for fully-fledged dApps that enable versatile and robust services.

On the negative side, the DPoS consensus algorithm made it possible for something like an oligopoly to evolve. That’s because the 21 block producers get the highest network rewards, have the most voting power and can make decisions that don’t fit with the original network paradigm.

As a result of these disagreements, some developers chose to fork the EOS into other networks, including Telos, WAX, and BOScore.

EOS has implemented modifications of consensus algorithms, including asynchronous Byzantine Fault Tolerance (aBFT), Transaction as Proof of Stake (TaPoS) and Delegated Proof-of-Stake (DPoS). A brief description of each of these elements is shown below.

aBFT — This provides 100% confirmation of transaction irreversibility within 1 second and is essential for ensuring network participants do not suffer from delays.

TaPoS — This forces all transactions to include part of the hash of a recent block header. This prevents transaction replay on forks that don’t have the referenced block and also signals a user’s position on a specific fork, as well as their current stake.

DPoS — This is an algorithm that allows users to select block producers using a unique voting system.

The EOS blockchain is relatively fast. Blocks are produced in rounds that involve selecting 21 BPs, who are required to produce 6 blocks each and 126 overall. The order of block processing is decided by the 15 top BPs and if a BP misses some blocks over a 24 hour period, it can be excluded from the set of active BPs.

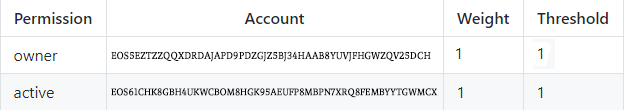

When creating an EOS account, users are provided with two permissions, one active and one owner.

The active permission is responsible for transferring funds, making account changes and voting for block producers. The owner permission is used to restore all underlying permissions that could become compromised.

The network also allows users to set nicknames in the account creation process, so they can rely on human-readable account names rather than long cryptographic addresses. Users can create a multi-signature account, where access is spread across different users.

An example where nicknames and a multi-signature account have been used is shown in the image below, in which every account is assigned a weight and its own private key. To access the owner’s permission, two accounts must cooperate to reach a specific threshold. Users can create their own permission structures using various tools, including eostoolkit.

If you wanna stay safe and be up to date — subscribe to our newsletter! We will send you our Security Handbook straightaway. You can expect insights, interesting content and updates from us.

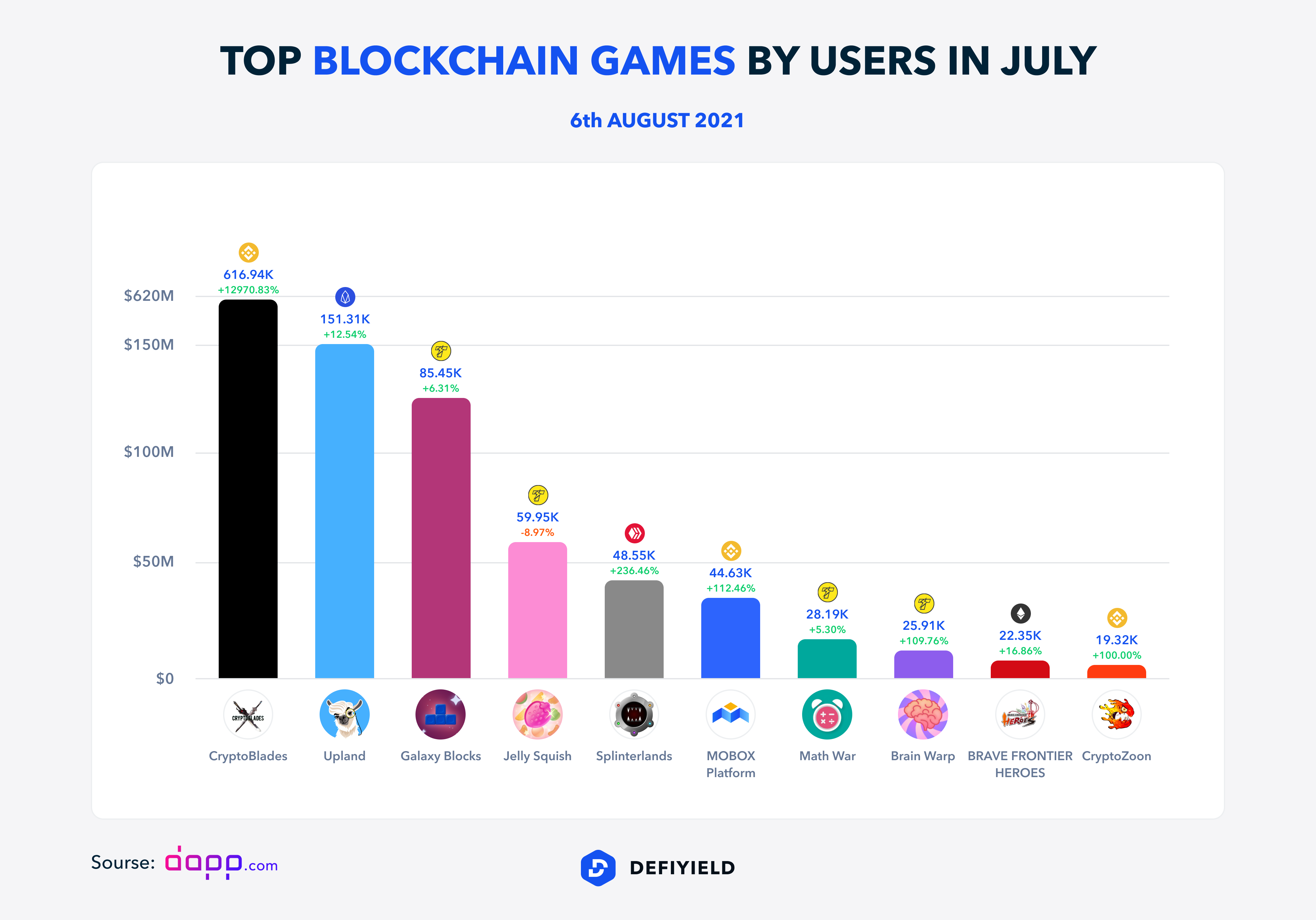

The EOS ecosystem is constantly growing for a number of reasons.

Firstly, developers only need to hold EOS coins (rather than spending them) to use the network resources for building and running dApps. Secondly, EOS is building its blockchain accounting for scalability, which attracts commercial-scale dApps who do not wish to hit any performance bottlenecks.

Today, the EOS ecosystem is thriving, with a healthy amount of funds locked up in various projects. However, there’s no valid source to rely on. We value Reddit community but we can’t provide the numbers taken out of Reddit threads.

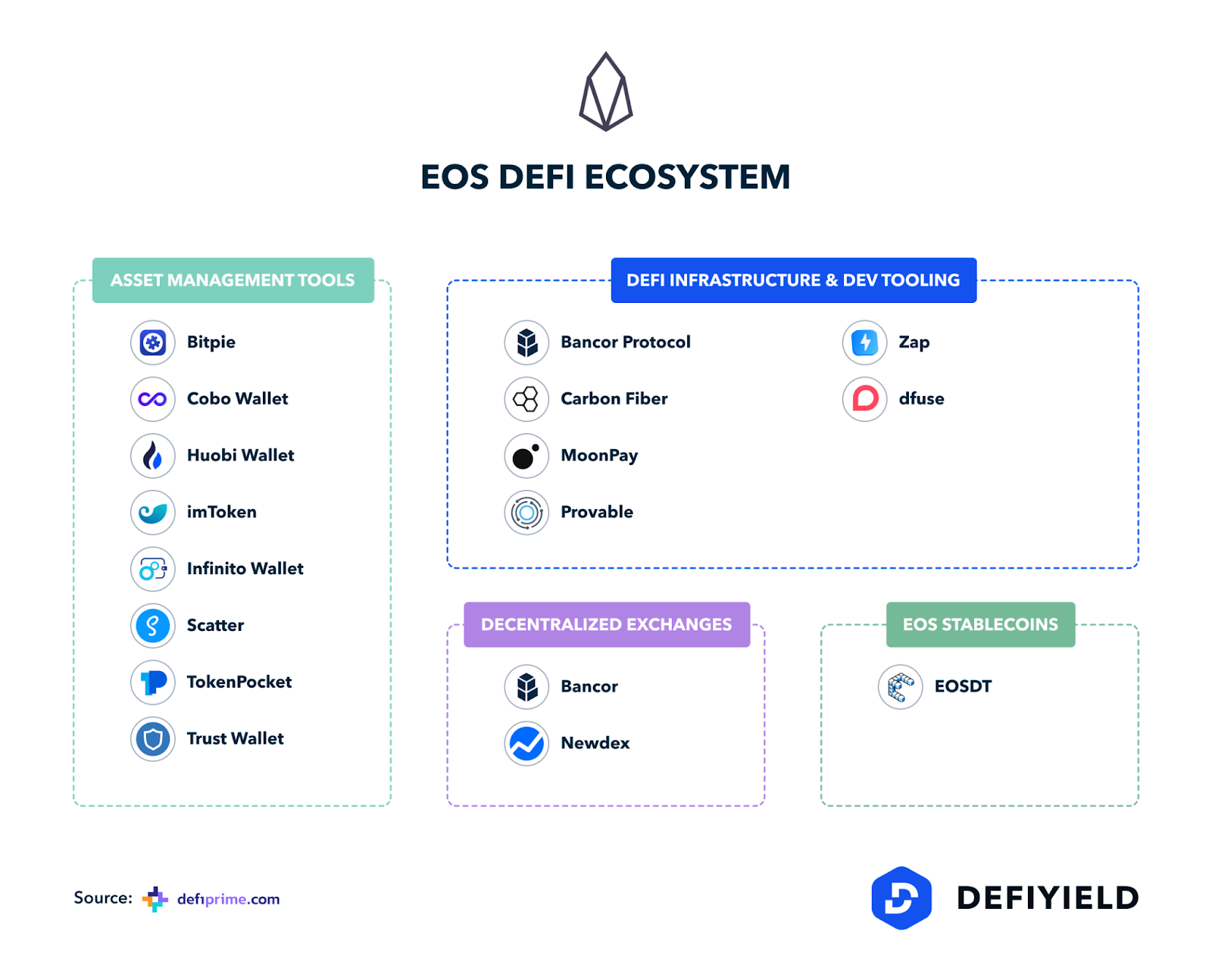

The TVL of EOS is spread across an ecosystem of projects, some of which are shown in the image below.

The following wallets can be used to interact with EOS projects. Both web wallet and software wallets are available.

**Lumi**

Lumi was founded in 2017 and you can use this wallet to manage EOS assets directly on the web, following a quick registration process.

One of the easiest ways to get EOS is to buy it from Coinbase and manage the assets with the native wallet. The Coinbase wallet is available as an Android or iOS application, as well as a Google Chrome extension.

**eToro**

This wallet, which can be downloaded as an iOS or Android application, can also be used for storing and exchanging your EOS.

**Dfox**

This is a smart bitcoin and crypto portfolio tracker for iOS and Android that also allows you to freely manage your EOS.

This is a desktop wallet for managing EOS assets.

**Guarda**

Guarda is a custody-free multi-currency wallet that comes in web, desktop, Chrome extension and Mobile forms.

Unfortunately, there are no ETH — EOS bridges for swapping assets without buying intermediary tokens.

Therefore, we advise you to buy EOS tokens directly on an exchange and to recharge your EOS account in this way. All new accounts created on the EOS network have to be funded during the creation time and the price for one account is usually only a few dollars.

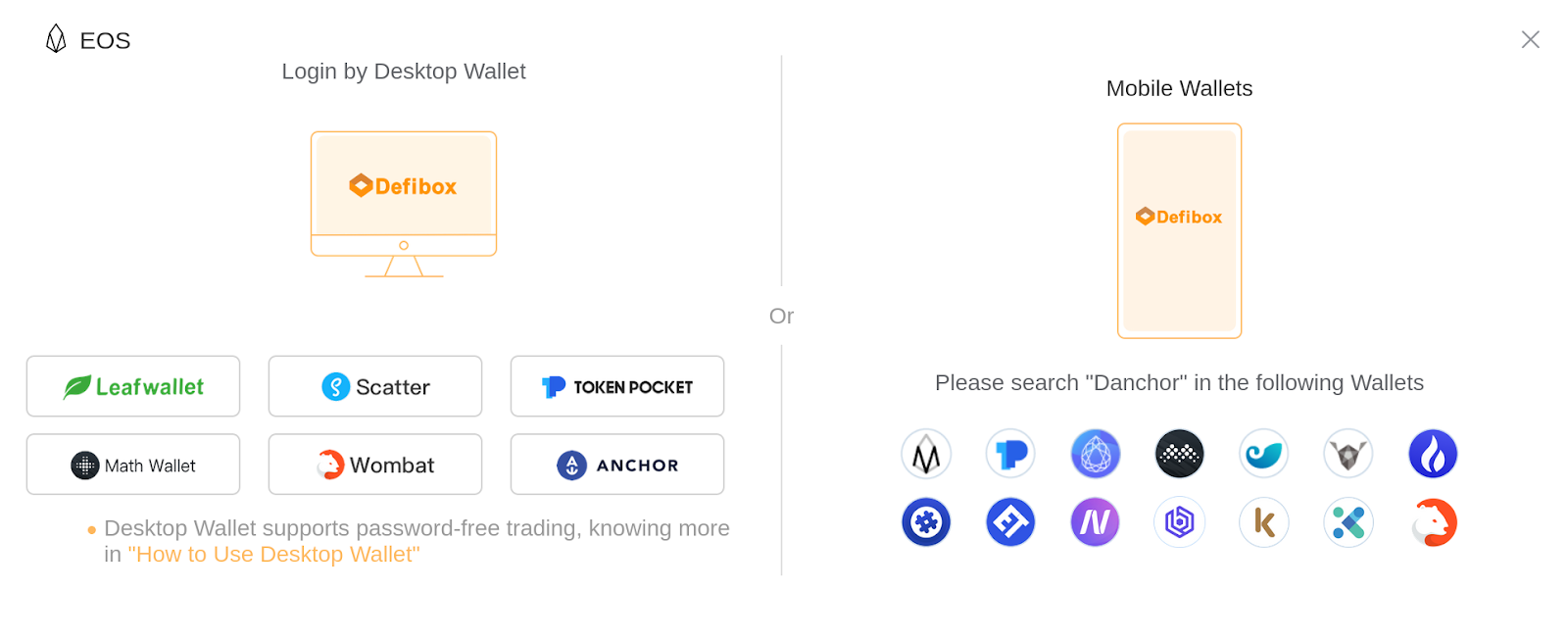

There are plenty of desktop wallets that can interact with EOS services, such as Leafwallet, Scatter, TOKEN POCKET, Math Wallet, Wombat, ANCHOR. In addition, a number of mobile wallets can be installed on iOS and Android to interact with the EOS network, such as TOKEN POCKET, Math Wallet, imToken.

For this run through, we will describe the ecosystem, which provides a lending service and the option to add tokens to liquidity pools. Once the desired wallet has been installed, log in to the system using one of the following options.

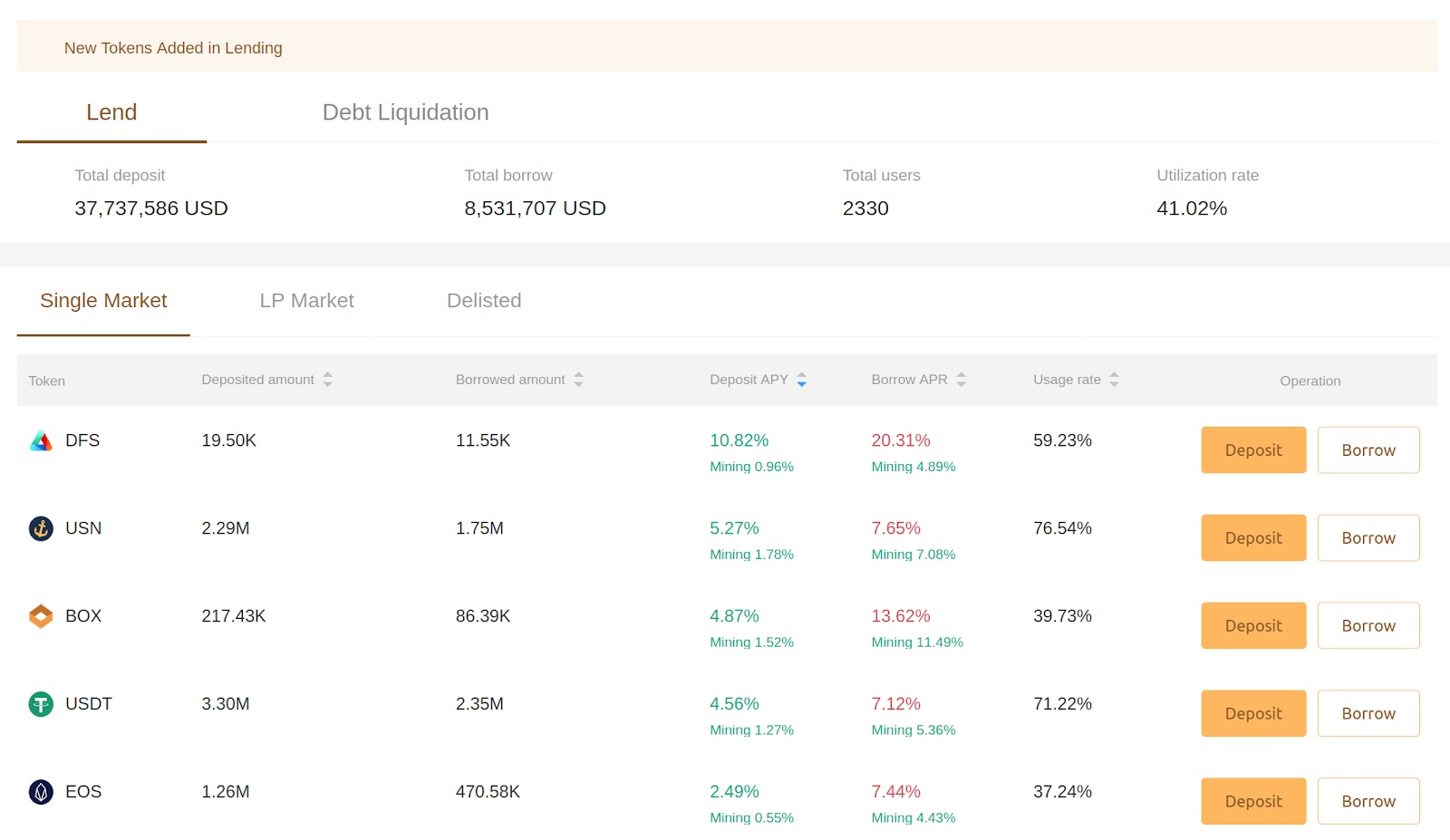

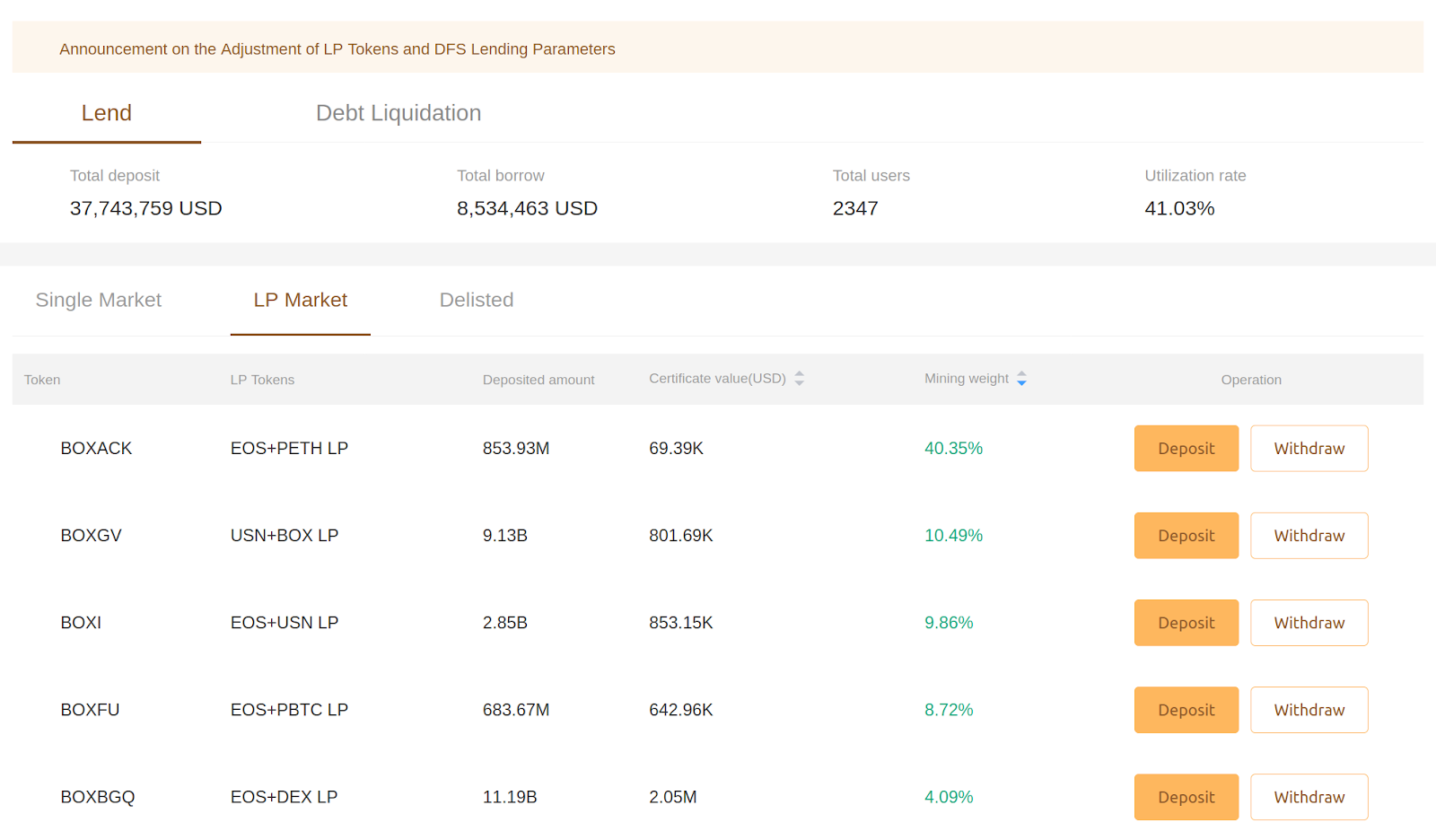

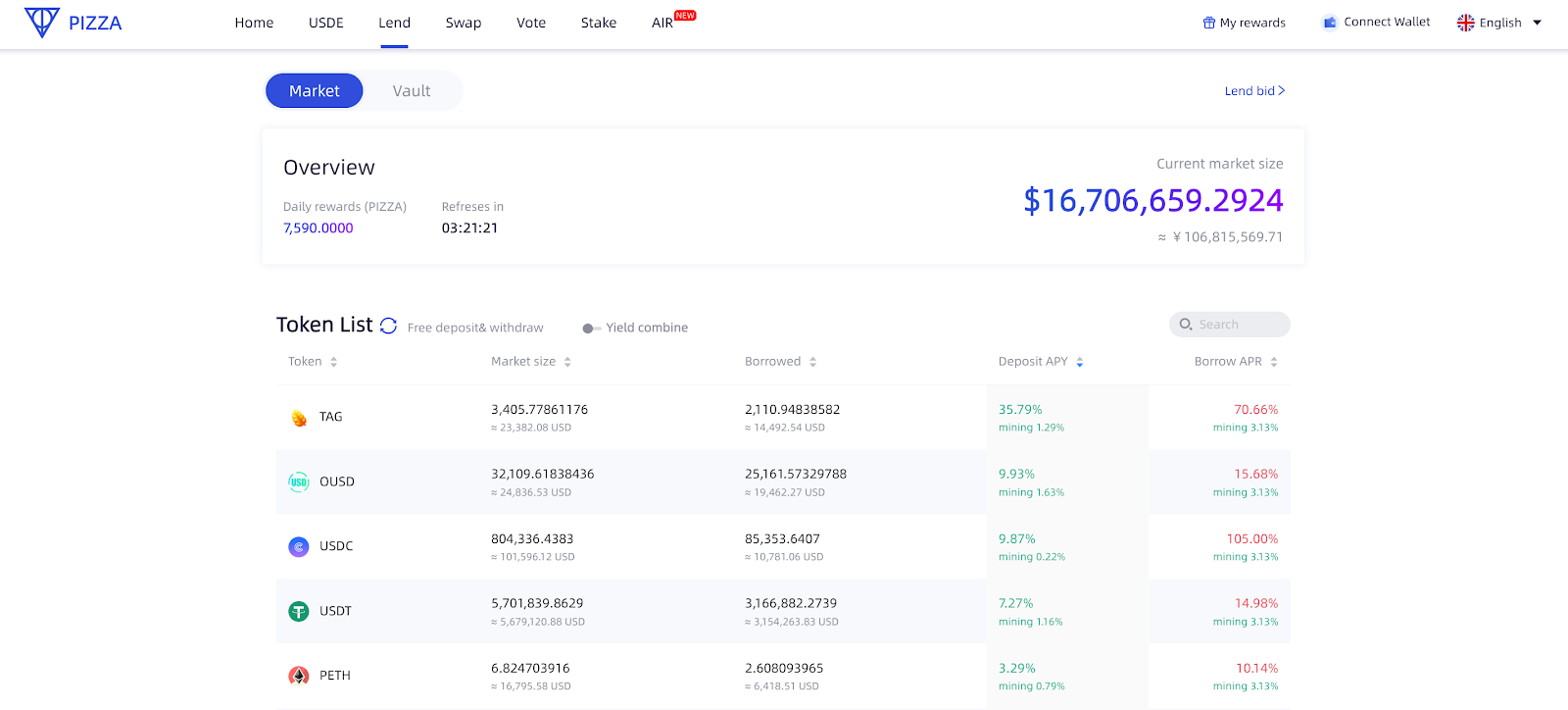

Users that want to generate yield from lending can do so by interacting with Pizza finance, which is one of the most popular EOS decentralized platforms.

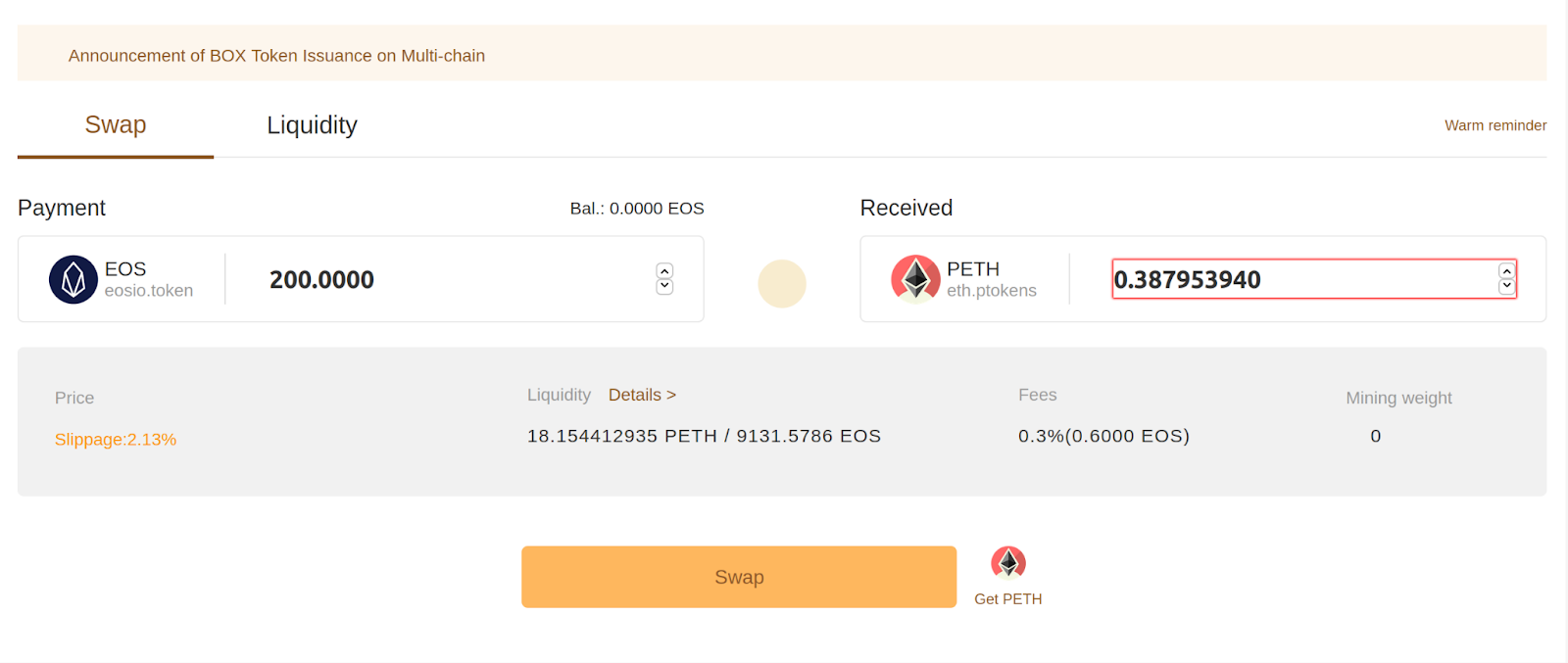

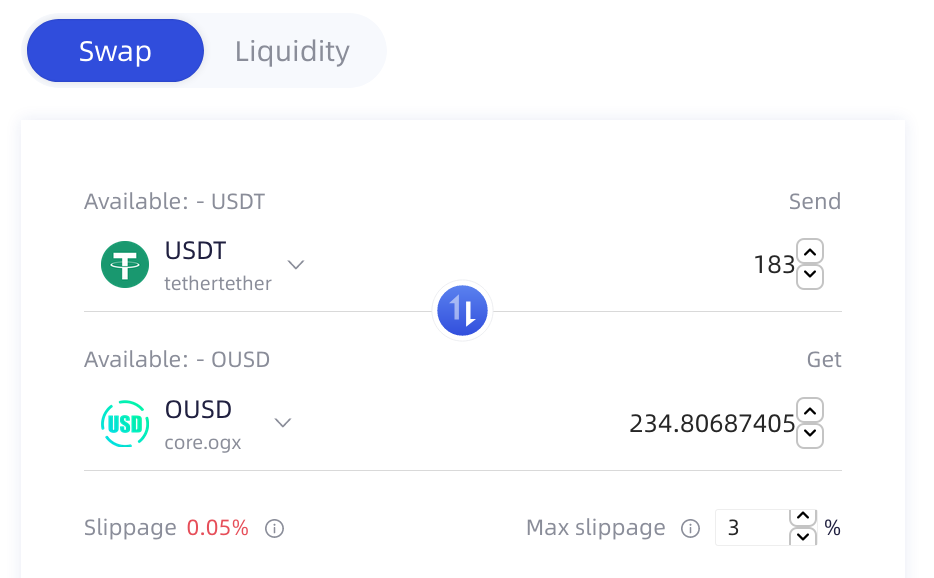

The swap mechanics work in the same way as on other services, with users needing to connect their wallet to the platform in order to perform financial operations. As always, it is better to choose more liquid assets, as assets with low liquidity are unstable.

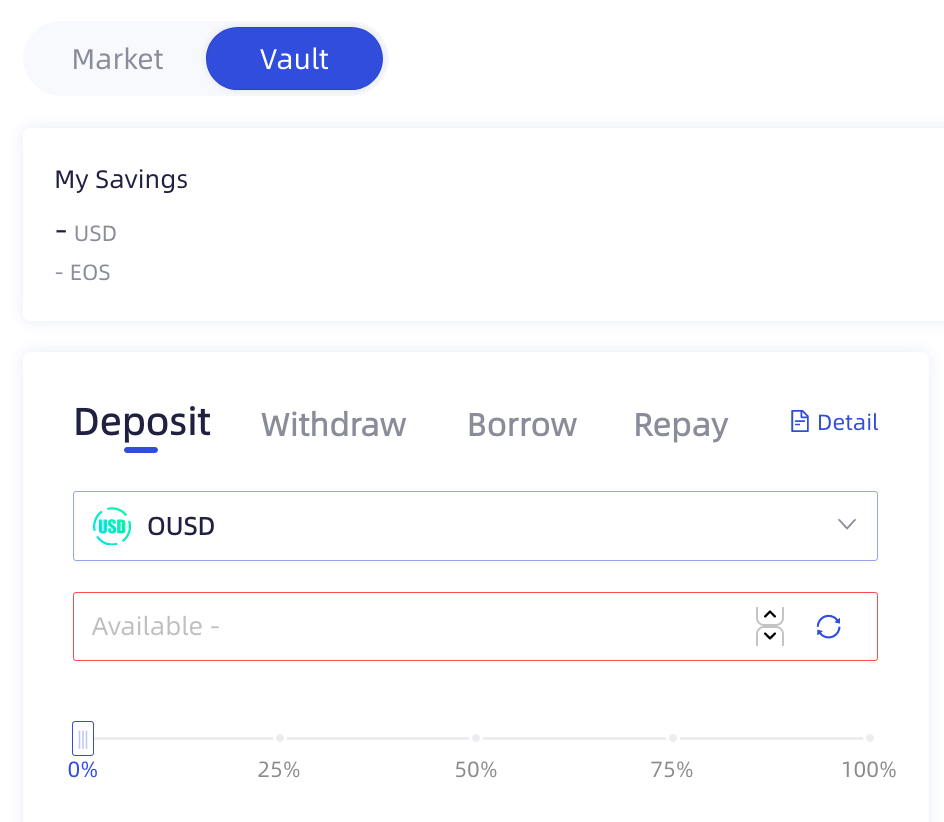

In this example, we’ll be concentrating on OUSD lending, which provides 9.93% deposit APY.

EOS uses a variety of different smart contracts to allow interaction with the most popular assets, such as USDT. As a result, there is sometimes a need to perform a double-swap to get the right asset for lending. In this case, we have EOS and we need to swap it for USDT first. Then we can swap the USDT for OUSD.

Before performing any type of lending operation, remember to check which assets can be swapped against each other.

Earned tokens will be added to this balance and can be withdrawn at any time.

Moreover, here you can check yield farming opportunities on other chains: https://de.fi/explore

EOS was one of the most talked about blockchain projects only 3 years ago yet it hasn’t managed to capitalise on this attention in a really meaningful way.

In many ways, the project has stagnated in this time but it is once again gaining attention for a number of reasons today.

Of course, there’re no reasons to start farming without doing research. Our advice is always the same — DYOR and don’t invest more than you can afford to lose.

Advocates of the EOS project will certainly be hoping so and, if this is the start of something big, now could be the perfect time for adventurous yield farmers to take advantage.

If you do, let us know what you think!

Join us on twitter and telegram!

Good luck in farming!

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

As the crypto bull market heats up, more investors seek to navigate the burgeoning world of decentralized finance (DeFi).

When engaging with decentralized finance (DeFi), investors often face the challenge of managing investments, tracking yields, and ensuring they keep all their assets safe.

January 2024 was an incredibly important month for us. We achieved significant results and made remarkable progress.

With new crypto ecosystems popping up on a regular basis, the integration of different blockchain networks with popular wallets is a key narrative moving into the next crypto cycle.

This month, we are proud to announce that De.Fi has secured investments from the first BTC ETF provider. We're seeing a huge spike in mentions and social interest in De.Fi and $DEFI token right before the listing.

© De.Fi. All rights reserved.