De.Fi: The Best Alternative to Zapper

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

If you like Ethereum DeFi, you’ll love Polygon.

While the DeFi summer crypto bull run of 2020 was a pure Ethereum play, DeFi has grown and morphed since then to include projects built on Binance Smart Chain, Huobi Chain, and other networks. Some DeFi users haven’t welcomed these new players because they don’t believe they are as decentralized as Ethereum or because they consider Ether a more secure native token and would prefer to operate within the original smart contract platform.

Whether you have reservations about other networks or not though, DeFi on Polygon provides opportunities for all Yield Farmers and this guide aims to get you started within this innovative new network. You’ll find out how it operates, what value proposition it brings to the crypto community, and how to take advantage of the yield farming opportunities that exist within it.

Scalability is one of the oldest problems in blockchain. At various points in the past, demand for transactions to be processed and the inability of major networks to do this in a fast or cost-effective way has frustrated users and led critics to the conclusion that blockchains will never serve the masses.

With all difficult problems though, the brightest minds in any industry have put their minds towards solving the scalability issue. This is exactly why Polygon, or Matic as it was previously called, was established.

Polygon is a second-layer solution built on the Ethereum network, which aims to eliminate Ethereum’s network congestion issues, high transaction fees, and low processing speeds. The team has created a full-fledged framework that enables a network of interconnected blockchains.

Within this framework, Polygon plans to implement the ZK and Optimistic roll-ups as part of their scaling solution. ZK roll-ups bundle transactions together before broadcasting this bundle to the network, significantly lowering transaction fees for every sender. Optimistic roll-ups make transactions instant.

In order to attract professionals to the ecosystem, Polygon has added the Ethereum Virtual Machine (EVM), so that everyone who knows Solidity development within the Ethereum protocol could create and deploy their solutions within Polygon. In this way, Polygon provides a user-friendly abstraction layer with proprietary SDK and WalletConnect support.

Polygon has also secured the network by implementing the Proof-of-Stake (PoS) consensus mechanism, allowing the native MATIC token to be staked, as well as securing the network’s sovereignty in the long run.

The project plans to roll out an interface that will bridge users and merchants, providing a set of APIs and SDKs that allow both parties to accept or pay in cryptocurrencies. The system will also support atomic swaps, cross-chain payments, and fiat payments in the near future.

Polygon has contributed to the development of the Plasma MVP (More Viable Plasma) and implemented an adapted version of the Plasma.

The Polygon framework allows for side-chains to be created, which rely on the main Ethereum network but massively improve transaction speeds and decrease fees. The Polygon side-chain achieved almost 10,000 TPS on the test net, which represents a major improvement in horizontal scaling.

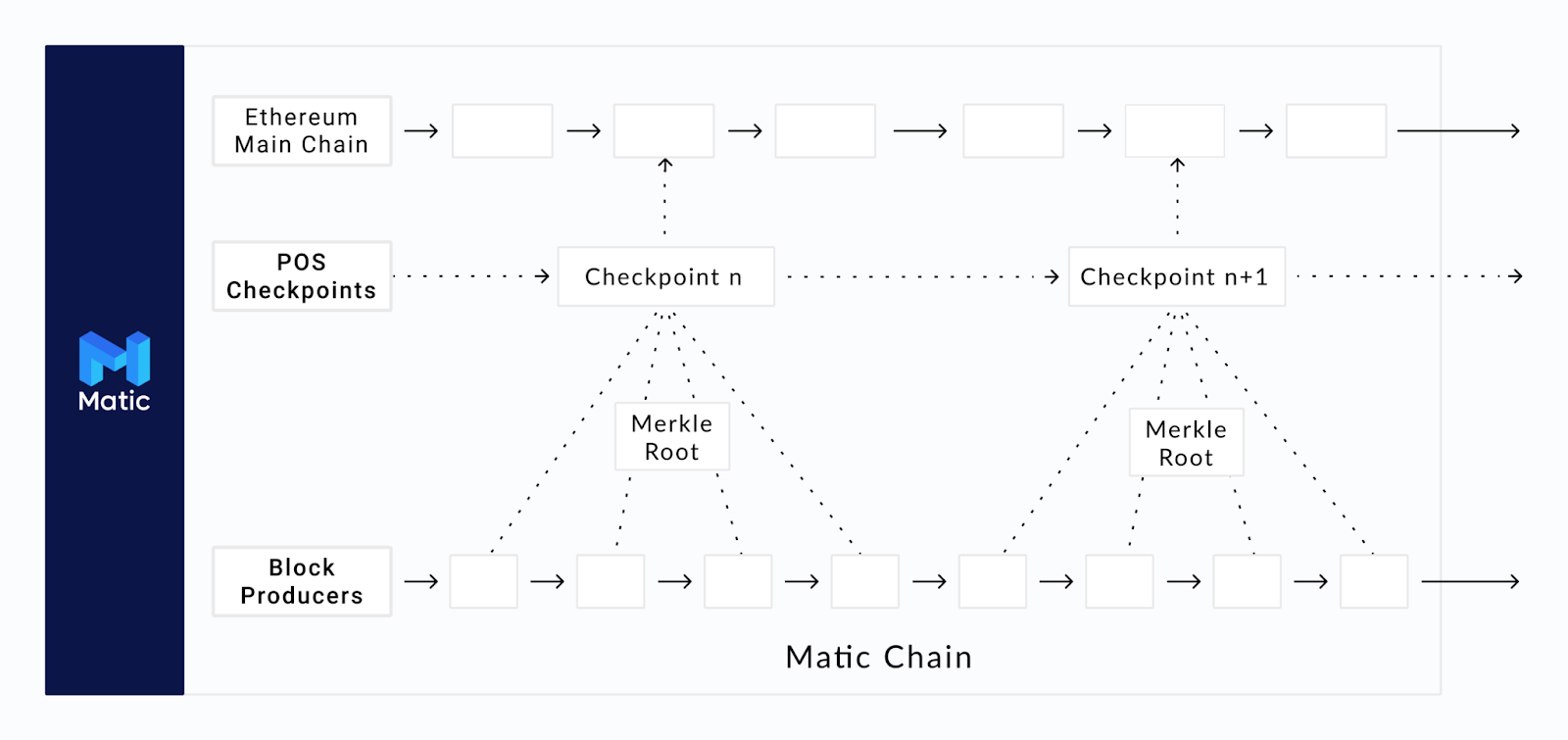

The network is divided into two layers, the Matic Block Layer and the POS Checkpoints Layer.

This layer operates via Proof-of-Stake, with stakers choosing block producers on the base layer to create blocks. To achieve faster block generation times, the number of block producers is limited so that it could achieve block generation times of under 2 seconds.

This layer represents an additional network layer that synchronizes with the Ethereum Main Chain once a specific number of blocks have been produced on the Matic Block Layer. To enable this, Polygon has introduced Checkpoints, which contain block information received as a Merkle Root from the Block Layer.

The Checkpoints Layer provides significant security through the implementation of Fraud Proofs and a Proof-of-Burn mechanism, both of which are described below.

This is a simple mechanism that enhances the security of transactions by allowing network participants to submit details of any fraudulent ones. If network participants agree that a transaction is risky, the fraudulent stake gets slashed and the challenger receives these slashed coins as a reward for their fraud prevention efforts.

The Checkpoints Layer plays an important role when users withdraw funds, enabling them to prove the remaining balance on the root contract using Patricia Merkle and header block proofs. The header block must be provided to the Checkpoints Layer through the Proof-of-Stake mechanism.

If you wanna stay safe and be up to date — subscribe to our newsletter! We will send you our DeFi Security Handbook straightaway. In the ebook we explain how to stay safe, what are we paying attention to while auditing projects and what should you do to not get REKT. You can expect insights, interesting content and updates from us.

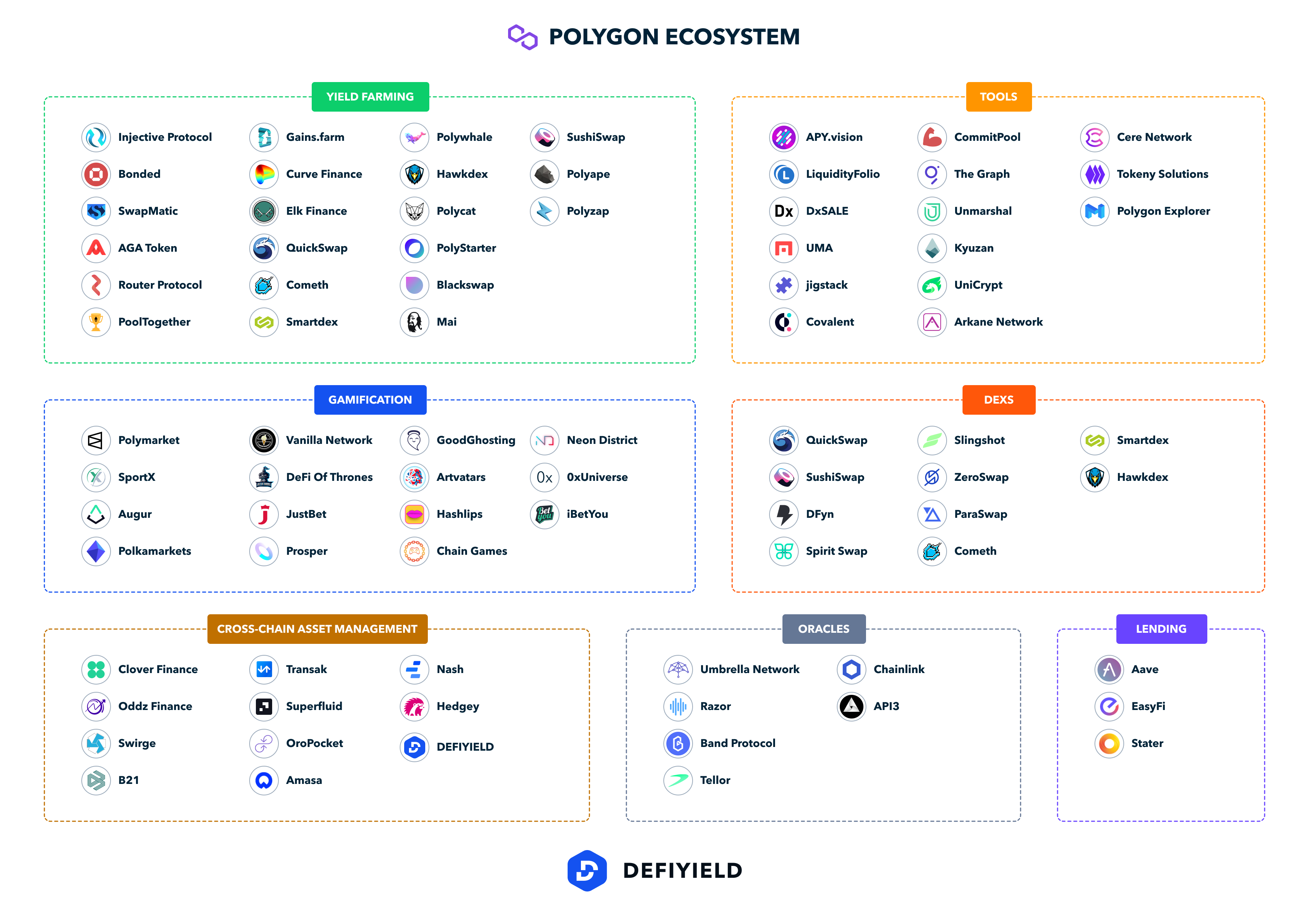

The network is being improved at a breakneck pace, with many projects striving to provide a range of different services. According to our analysis, the network is very active and has all it needs to disrupt the DeFi field as a second-layer solution.

One example worth considering is QuickSwap — the best-known decentralized exchange (DEX) on Polygon, which is similar to Uniswap. It runs on the Layer-2 and became very popular across the community because it allows trading at high speed while maintaining close-to-zero fees.

QuickSwap was launched in February 2021 and, according to recent data from the last seven days, has a steady and positive dynamic. It can definitely be assumed that the network will continue to flourish, providing users with next-gen financial instruments.

The Polygon network will distribute rewards amounting to $45 million in two phases. 0.5% of the total supply will be distributed as rewards for users until June 14th 2021 and then, from June 14th 2021 until April 13th 2022, the next batch of tokens will be provided.

There are three ways a user can interact with the Polygon network and receive rewards. The first involves lending your tokens on services such as AAVE, the second is by staking your MATIC tokens and the third is through yield farming.

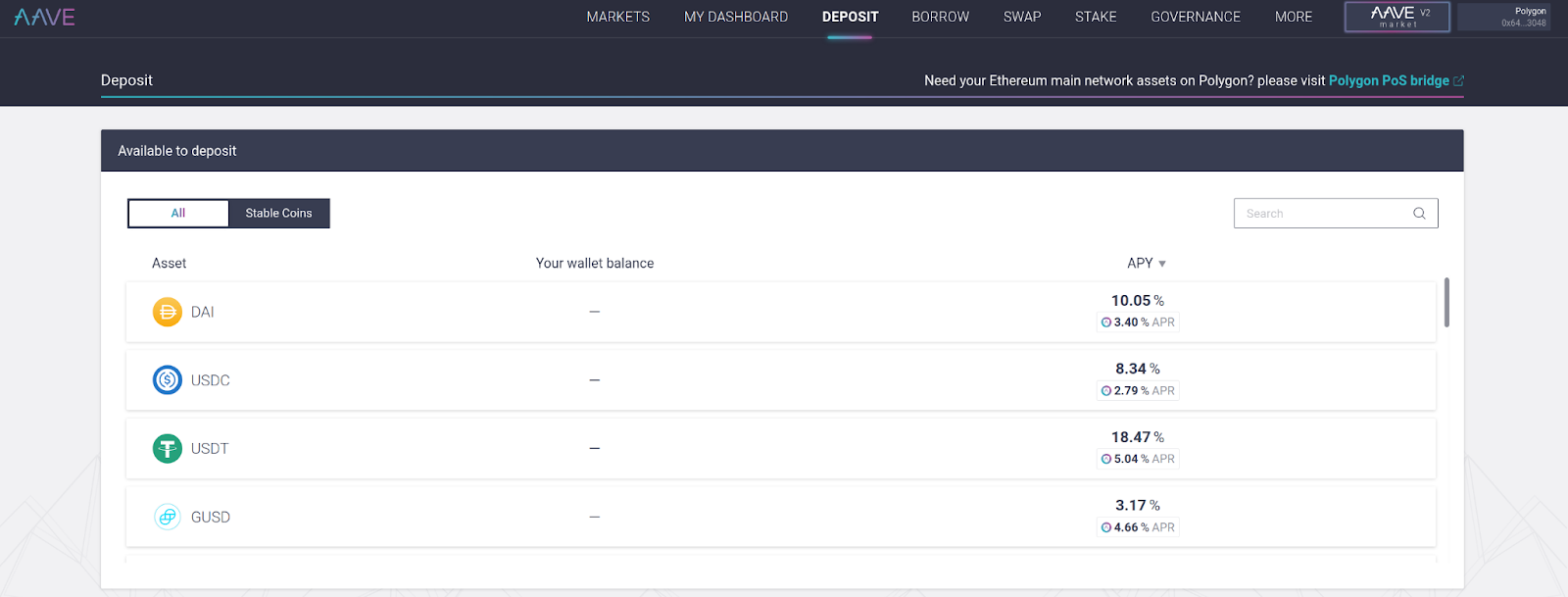

If you want to lend tokens, AAVE supports markets for DAI, MATIC, AAVE, ETH, USDC, USDT, and WBTC. If you lend one of these, you receive rewards in the form of WMATIC tokens. If you want to stake your MATIC tokens and receive rewards, refer to the official staking guide.

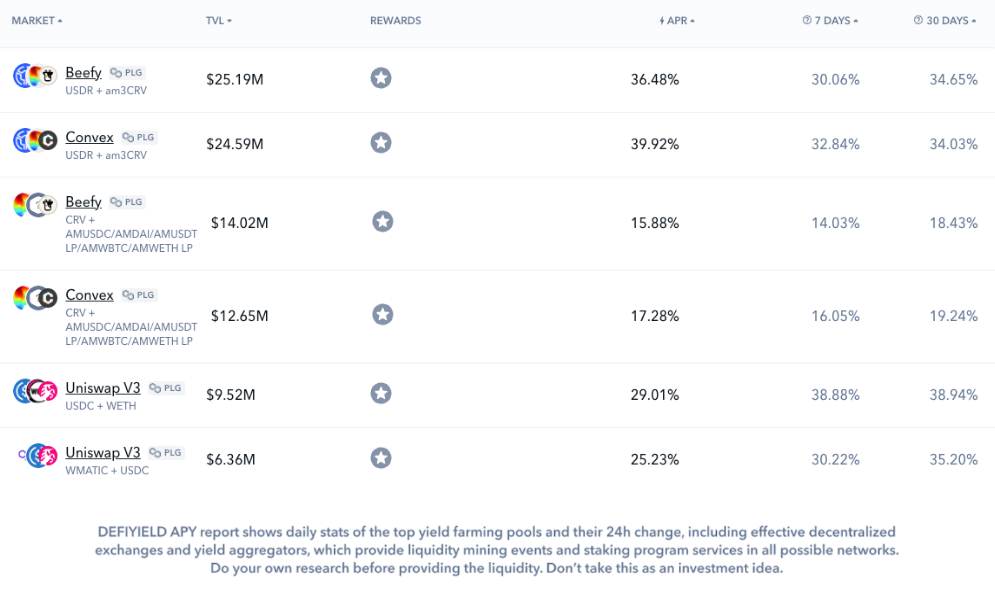

If you want to start yield farming, you need to choose a liquidity pool and have the required tokens to enter it. Below is a screenshot from our DeFi yield farming explorer tool with a sampling of high TVL pools with impressive APRs:

You can use this link to explore live Polygon DeFi opportunities.

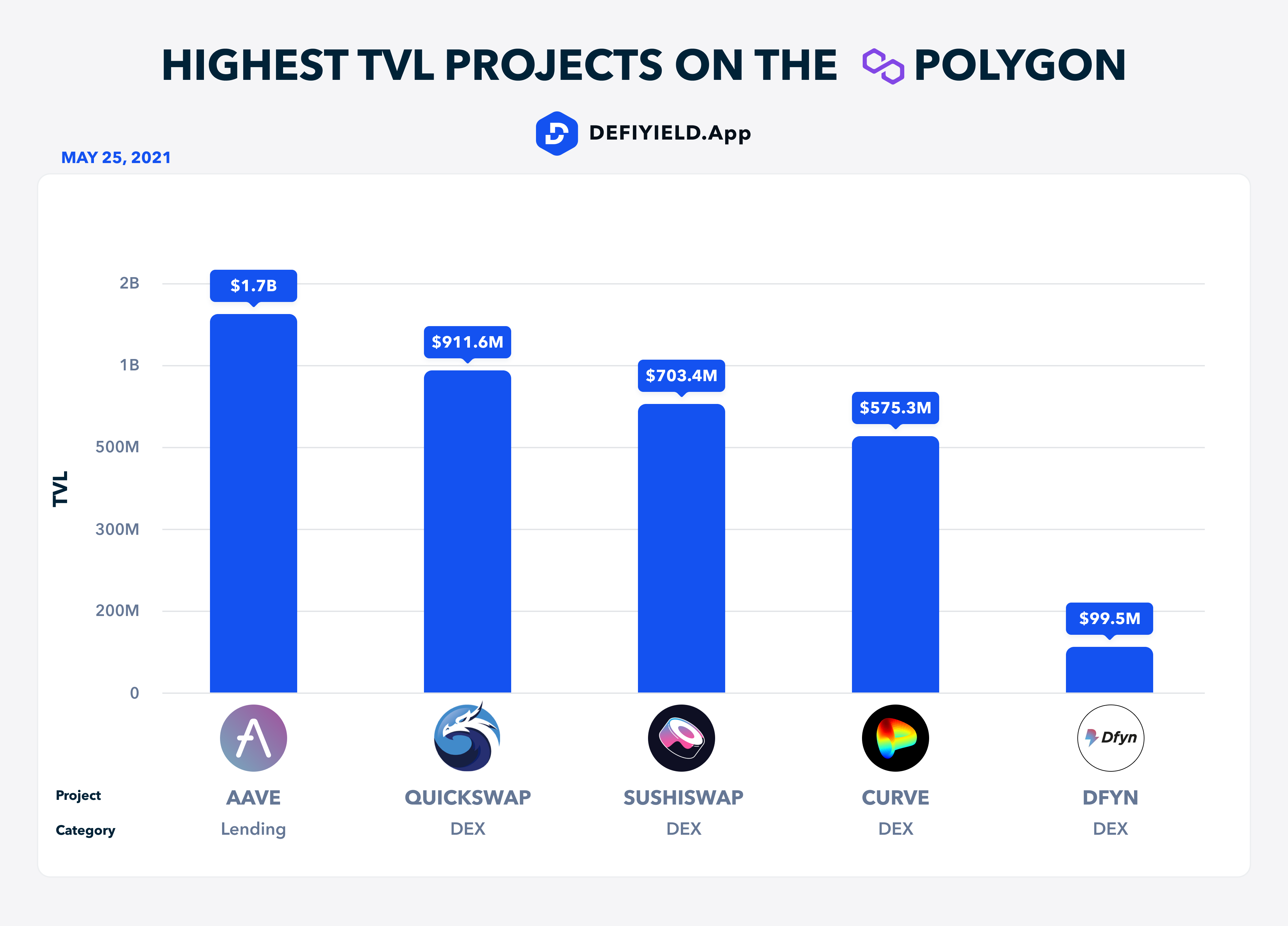

Also, here’s a quick overview of the highest TVL across different platforms on Polygon.

Want to know more about Decentralized Finance? Everything you need to know is in our book! Available NOW on Amazon!

Currently, three wallets support interaction with the Polygon network and these are MetaMask, WalletConnect and WalletLink. Of these, MetaMask is the best option for managing a wide range of assets.

MetaMask can be downloaded and installed as a plugin for Chrome and for Firefox if you don’t have it already. If this is your first time using it, make sure to save your seed phrase in a safe place, as this is the only way to access it again if you lose your password.

Once you have set the MetaMask, you need to connect the wallet to the Polygon Network to start interacting with dApps. To do this, click on the upper dropdown menu and choose ‘Custom RPC’ from the list.

Then you need to fill in the fields with the following network information:

You will then be able to choose the Polygon Mainnet from the list of available networks.

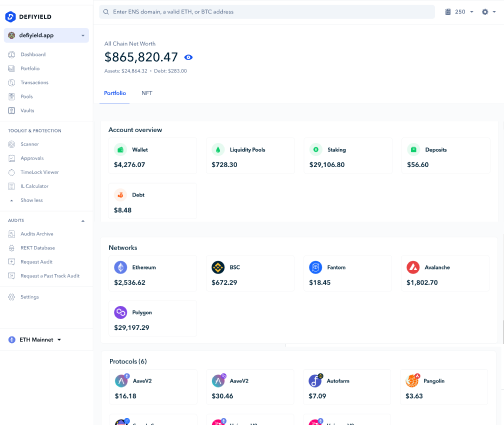

Now you can track your balances, assets, deposits and staking with our DeFi crypto wallet tracker.

To check your Polygon assets, simply click on “Dashboard” and choose Polygon network.

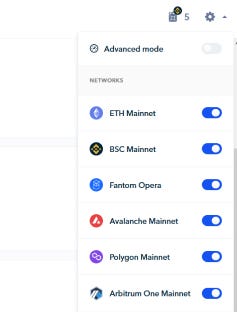

Or, use a customization bar to configure networks.

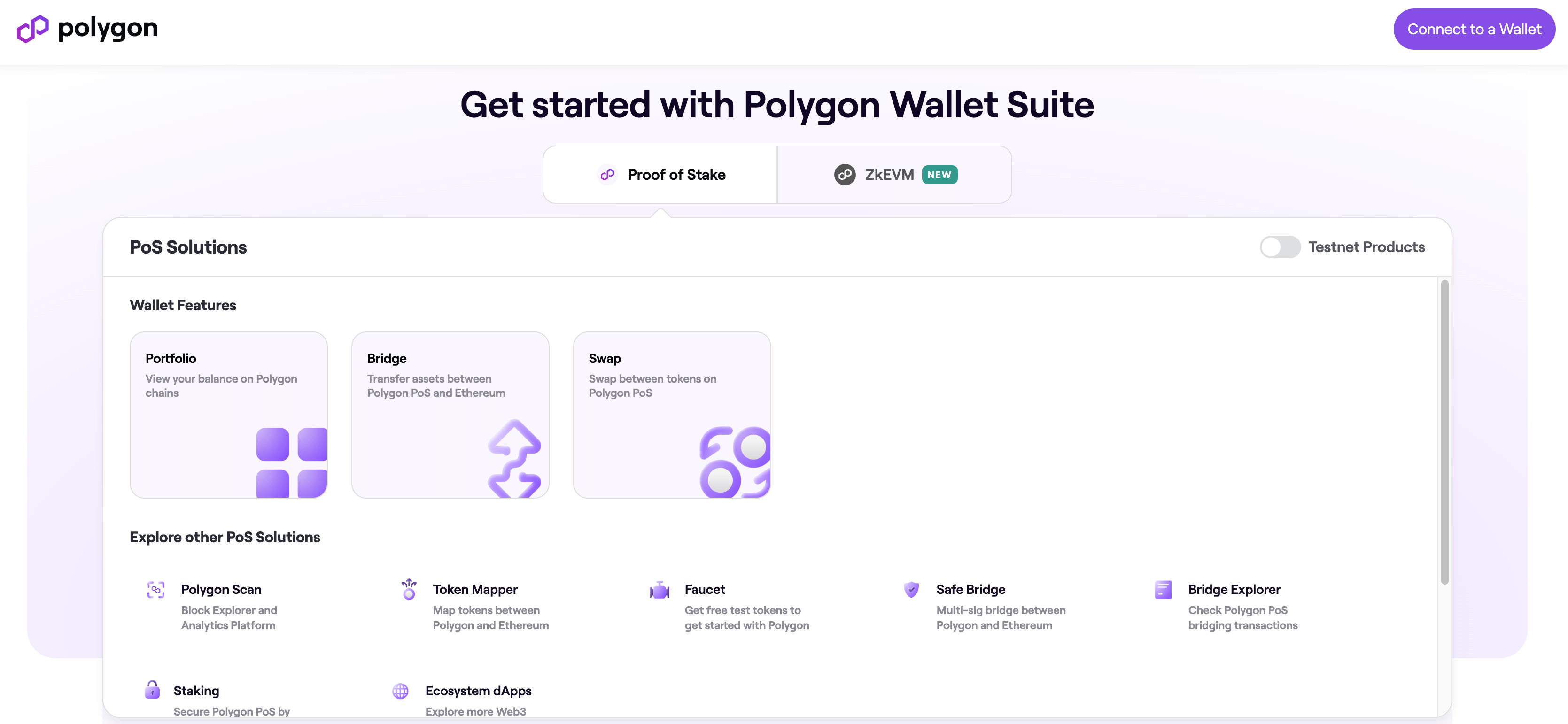

Once you have set up Metamask, the first issue you may encounter is that you need to bridge from Ethereum to Polygon mainnet.

You can complete this action by utilizing Polygon’s official bridge.

Some centralized exchanges also allow you to purchase Polygon assets directly, then withdraw them to a Polygon-enabled web3 wallet. This will allow you to skip the bridging process. However, when withdrawing assets from an exchange, always be sure to double check that you are withdrawing to the proper network. Failure to do so can result in a loss of funds.

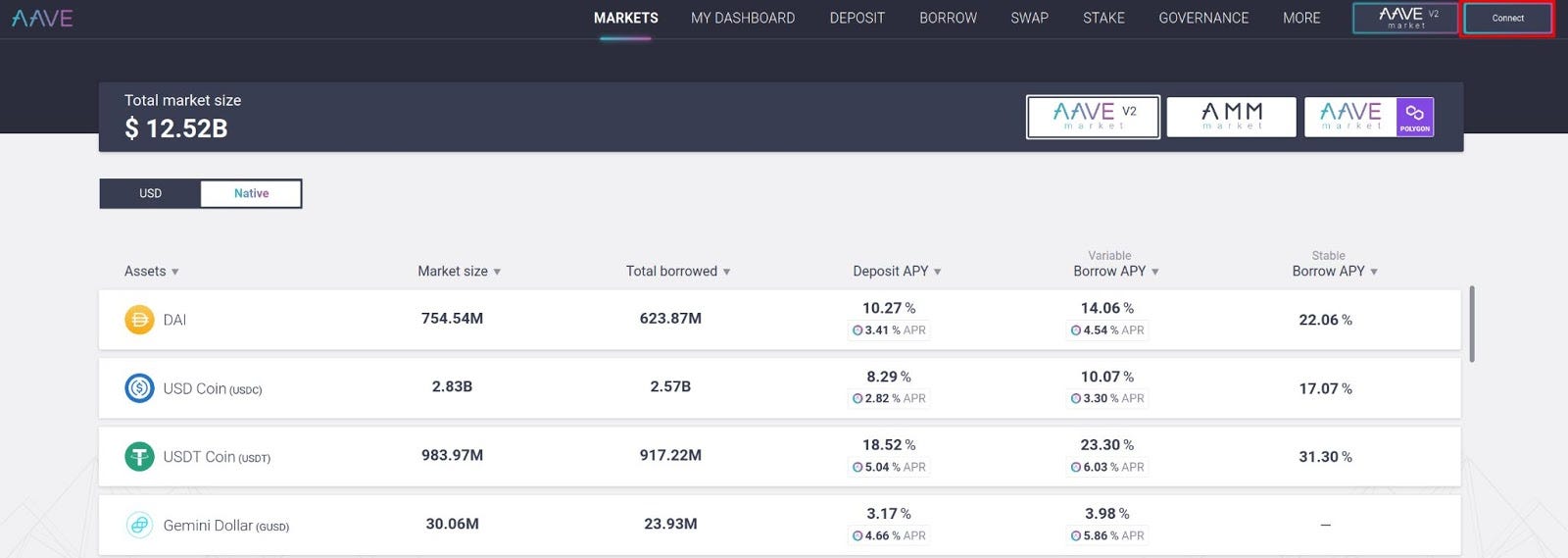

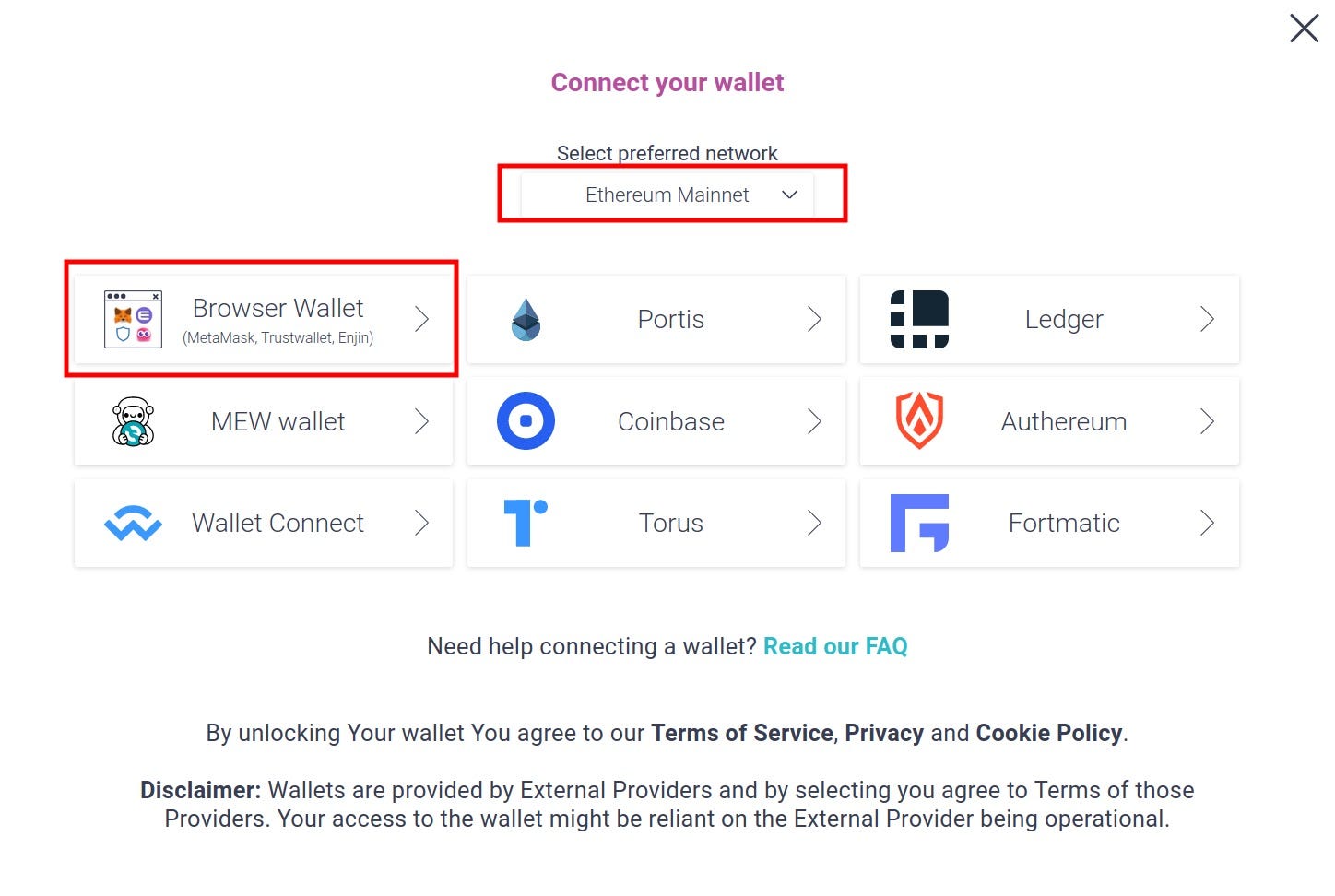

Go to the AAVE markets page and click on the ‘Connect’ button located in the top right corner.

Make sure that you choose the ‘Ethereum Mainnet’ in the upper dropdown menu, then navigate to the ‘Browser Wallet’ section and choose the ‘MetaMask’ wallet.

Once your ‘MetaMask’ has been successfully connected to Aave, you will see the available markets for lending tokens on Polygon. You should choose a market that provides a high APY (Annual Percentage Yield).

The first step you need to take is to deposit your assets to AAVE. Click on the ‘Deposit’ **button located on the main toolbar and choose an asset that you want to deposit. Then click on the deposit button to complete the operation.

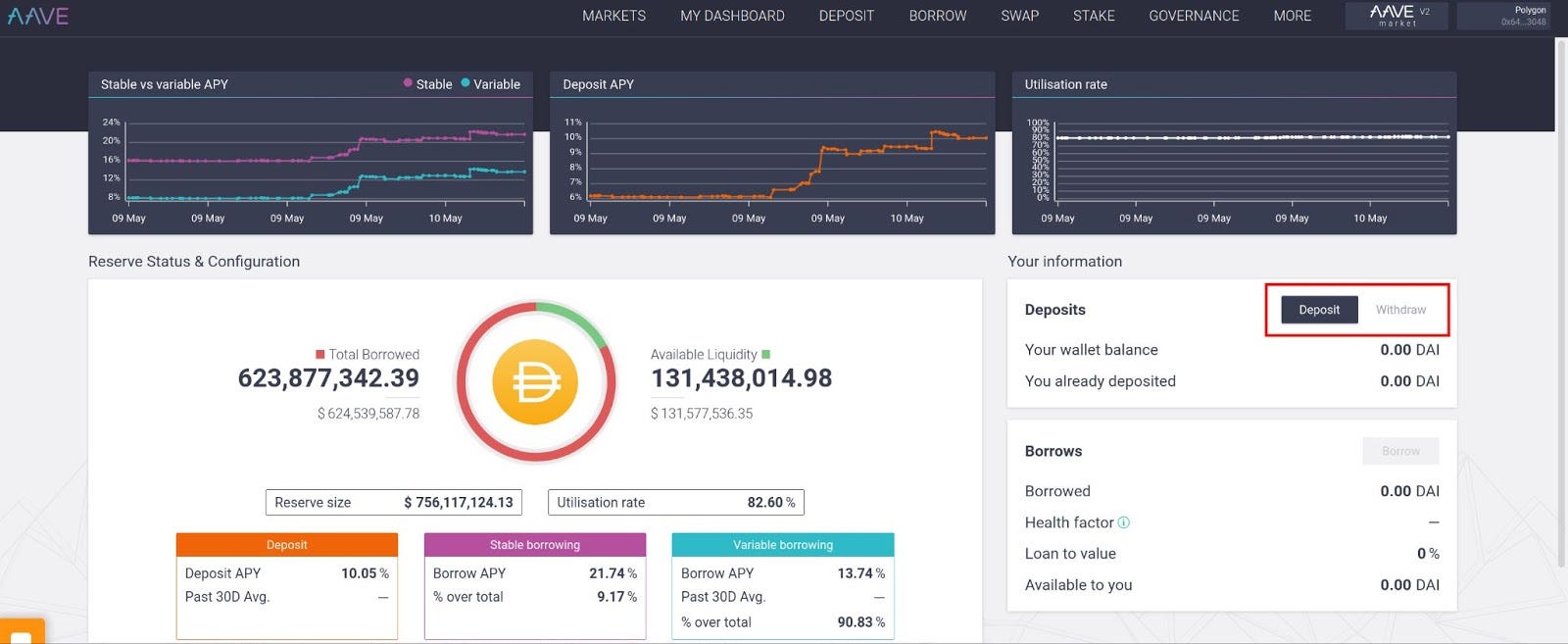

Once your funds have been deposited, you will participate in the pool as a liquidity provider and receive rewards in AAVE and WMATIC.

To check or withdraw your rewards, navigate to the ‘Markets’ section and choose the desired asset from the list. You will then see the ‘Withdraw’ button and all the data regarding your yield farming rewards.

If you want to Yield Farm on a network that is closely linked to Ethereum but already has a solution to high transaction fees and low processing times, Polygon is a great option.

You’ll find lots of similarities if you’re already familiar with Ethereum DeFi and, even if you’re not, you’ll find an experience that does away with many of the issues that Yield Farmers have experienced so far.

It’s a network that is EVM compatible, so lots of existing DeFi developers can deploy their solutions on it and many already have. You can also use the well-known Metamask wallet that most DeFiers and Yield Farmers are familiar with.

Finally, there’s the fact that the liquidity mining rewards have only just begun and still have over a year to run from now. All in all, Polygon is definitely worth a go!

What is TVL (Total Value Locked) in DeFi?

Upcoming Crypto Airdrops for 2023

Smart Contract Audit Services

Crypto Hack & Scam Database

Free Smart Contract Audit

Revoke Crypto Wallet Permissions Tool

And join us on Twitter and Telegram!

Good luck in farming!

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

As the crypto bull market heats up, more investors seek to navigate the burgeoning world of decentralized finance (DeFi).

When engaging with decentralized finance (DeFi), investors often face the challenge of managing investments, tracking yields, and ensuring they keep all their assets safe.

January 2024 was an incredibly important month for us. We achieved significant results and made remarkable progress.

With new crypto ecosystems popping up on a regular basis, the integration of different blockchain networks with popular wallets is a key narrative moving into the next crypto cycle.

This month, we are proud to announce that De.Fi has secured investments from the first BTC ETF provider. We're seeing a huge spike in mentions and social interest in De.Fi and $DEFI token right before the listing.

© De.Fi. All rights reserved.