De.Fi Audit Database Update, We’re Hiring, Insights from CTO and MORE! - Late May Development Recap

The end of May brought important updates across...

If this title sounds exaggerated, you haven’t been paying attention.

Decentralized Finance, or DeFi, is Finance 3.0 and it has just begun. We’ve been in it from the start and we truly believe it will totally transform the global financial system in the years to come. Banks that have been custodians of the people’s money for centuries will finally see the full effect of their years of contempt for the average citizen brought into sharp relief.

The people will make their choice and they will choose the open, permissionless and egalitarian system of DeFi over the walled gardens of the traditional financial elites. We really are just getting started.

It’s against this backdrop of an emerging finance revolution that we launch this landmark book. ‘The Wall Street Era is Over: The investor’s guide to Cryptocurrencies and DeFi, the Decentralized Finance Revolution’ has been written for anyone that is excited about DeFi, by the experts who’ve been in it from the start.

If you want to join the DeFi revolution to take control of your finances, generate yields and avoid the scams, this is the book for you.

De.Fi is now a significant cross-chain asset management ecosystem, with a vibrant and growing community of over 5,200 yield farming members who discuss new opportunities and strategies as soon as they appear.

We have grown into this amazing ecosystem in just ten months, having started out in July 2020 during the DeFi summer. In this time, we’re lost millions but made even more. We’re totally transparent about the journey we have been on because we believe this is an important characteristic of the DeFi community and one that demonstrates why we can be trusted.

When we were starting out, we just wanted to find easy ways to find, track and organize all of the new and exciting yield farming opportunities that were popping up. This was the start of our yield farming aggregator that is now within our cross chain asset management ecosystem.

As we progressed, we realised how hard DeFi could be during this nascent stage of its development. We lost $1.2 million in one of the most notorious yield farming scams of 2020, that of Compounder Finance. This is what led us into security and smart contract auditing.

Now, we are the leading independent auditor of smart contracts in the market with over 40 audits completed so far. In fact, we are the unique provider of this kind of audit, as we do not accept or receive any monetary reward for them and do not answer requests for audits that come from project teams. Only our community decides which ones they want us to look at.

All of this is because we agree with billionaire investor and DeFi advocate Mark Cuban when he says that

“if you don’t take care of the little guy, it’s going to backfire on the whole [DeFi] industry”.

We have been developing the De.Fi ecosystem of asset management and smart contract security tools over the last nine months for exactly this reason.

And this new book is just another example of how we are helping DeFi users to succeed and stay safe.

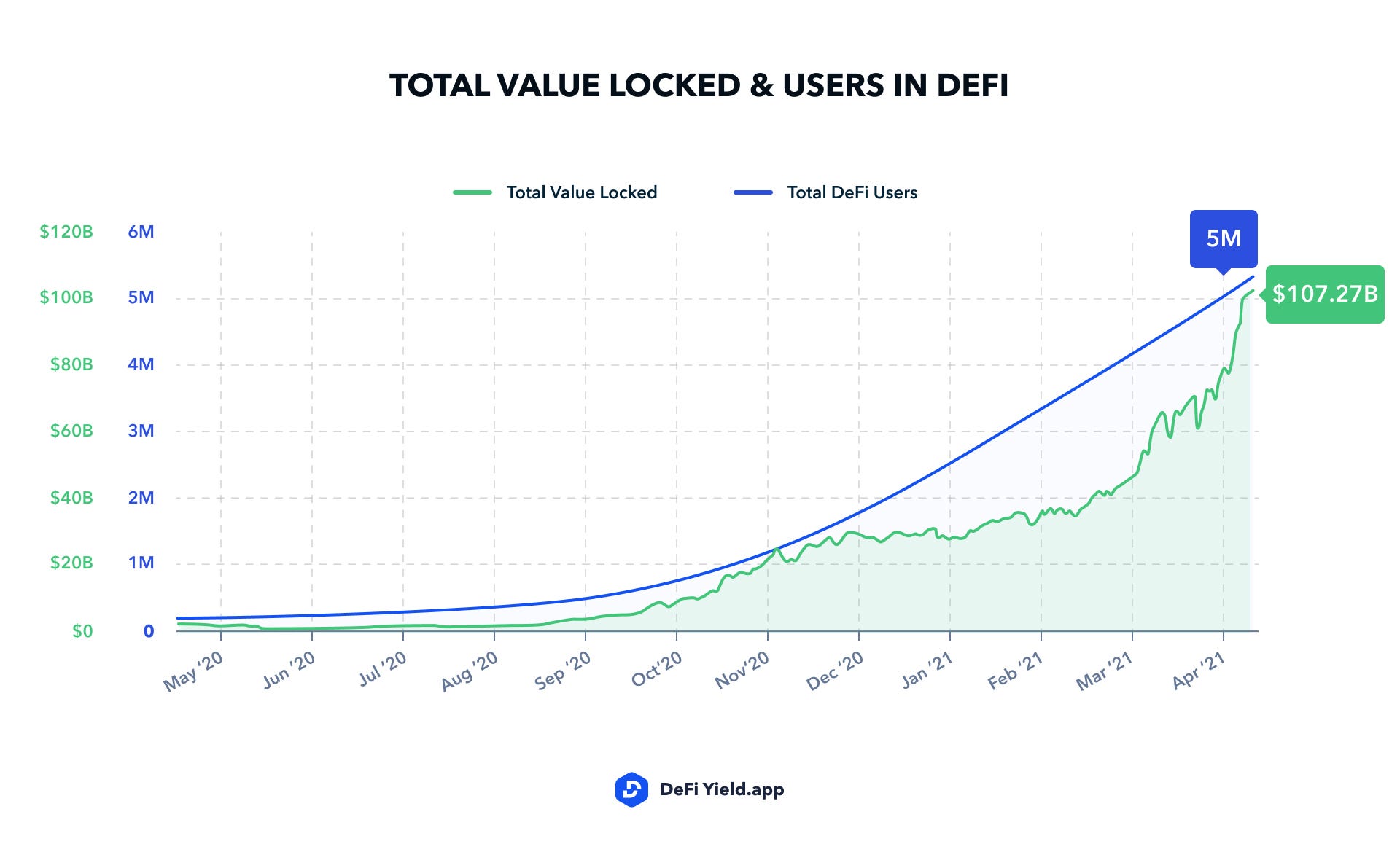

At the end of April 2021, Consensys announced that it’s non-custodial wallet Metamask has surpassed five million active users. This milestone represents extraordinary growth considering that it only surpassed one million users six months ago and it just goes to show how quickly the DeFi movement is gaining traction.

If you are not aware already, Metamask’s numbers matter because this is the main non-custodial digital wallet used to access DeFi and the wider Web 3.0 world. Someone uses Metamask to manage the digital assets they hold on various blockchains. They use it to interact with the DeFi applications that are built on top of these blockchains in order to lend, borrow, trade and swap digital assets.

This is what real DeFi looks like. Yet the five million Metamask users who are involved in real DeFi is just a small fraction of those involved in crypto more generally. For example, Coinbase has 45 million people who have gone through KYC to become registered users and are therefore willing to store their digital assets in a custodial wallet with a centralised party.

Virtually none of these users are taking advantage of the potential 100%+ APYs that are available in DeFi. Most will just be hodling Bitcoin and other coins in the hope they will increase in value, rather than putting their assets to work and generating generous returns from them.

The ability to generate yield from digital assets that goes beyond simple price appreciation is something that will likely attract other participants to DeFi too. For example, anyone with a foundational understanding of traditional finance will know how assets can generate returns through mechanisms like lending and borrowing. Sooner or later, they will see how DeFi provides this opportunity too.

Essentially therefore, we believe that DeFi has a huge wave of new participants ready to join who are looking for ways to make a success of this new and exciting journey. This book has been written so that anyone — whether you’re a participant in traditional finance with no crypto experience, a crypto hodler using centralized exchanges or even an existing yield farmer looking to learn from the best — can be successful and stay safe in the DeFi revolution.

This book is written by yield farmers for yield farmers.

You don’t have to know anything about yield farming when you start. Even if you are a yield farmer already though, you’ll still learn a lot. That’s because you’ll be learning from the experts. The whole DeFi Yield team has been there, done it and bought the t-shirt.

Even though we’ve made millions from successful yield farming, we’ve also experienced major losses. These painful experiences are what we want to help you avoid. We’ll share both the best practice security checks that will help you identify malicious smart contracts, as well as the DeFi secrets you need to succeed.

Essentially, what you’ll read in this book is both the theory and the practice. Many commentators talk about DeFi and cryptocurrencies while openly admitting they don’t hold any digital assets and have never used a DeFi protocol. This makes no sense to us.

We have not only tried and tested every major DeFi protocol, we’re among the small group of DeFi pioneers that were brave enough to adopt these innovative new systems early on. As a result, we’ve been rewarded handsomely when the protocols we believed in really took off.

However, as mentioned, not every strategy we’ve pursued has been a success. We lost money, a lot of it, but that didn’t deter us. What it did was enable us to learn from our mistakes. We can now clearly identify worrying functions within a smart contract and red flags within a project’s governance that should alert DeFi users to potential dangers. These are just some of the key topics we cover in the book that will accelerate your onboarding into DeFi and keep you safe while you travel through this exciting industry.

With everything we write, whether its code or content, we have two main objectives:

When we achieve these aims, we know that we are moving closer and closer to our main vision — onboarding as many people as possible into the DeFi revolution.

To tick all of these boxes and be useful for crypto novices and yield farmers alike, we knew the book had to cover a lot of different topics. That’s why the final product is over 120 pages in length and includes lengthy chapters focused on the following areas:

The most important DeFi protocols — this chapter looks at all the major types of DeFi protocol, including lending and borrowing, asset management, exchanges and brokerage services. It also describes in detail the most well known and respected protocols that all DeFi users should know, including MakerDAO, Uniswap, Compound and Yearn FInance.

How DeFi protocols earn revenue — in order to really understand return generation and yield farming in DeFi, users really need to understand how the protocols themselves earn revenue. This chapter covers the different types of revenue that various protocols can earn, the most notable examples and processes behind these mechanisms.

The DeFi investor rulebook — taking inspiration from ‘the intelligent investor’ framework, we set out the new rules for investing successfully in the Finance 3.0 revolution. Whether you want to approach this exciting opportunity conservatively or understand how DeFi ‘degens’ take big risks in order to generate big returns, it’s all available here.

What is Yield Farming? — yield farming is at risk of becoming a buzzword if poorly understood, so this chapter is all about helping you to understand what it really is and is not. This important chapter looks at the different types of yield farming, its advantages and disadvantages, as well as strategies for success from experienced yield farmers that you can follow.

The Future of DeFi — as well as passing on all our information about how DeFi works now so you can stay safe and succeed, we want to also give you a glimpse of the future. We highlight the key trends that you need to keep your eye on — including interoperability, NFTs and governance-enabled growth, which will help you long after you’ve finished reading.

If you’re interested in owning and reading the resource that will become your DeFi bible for investing, that’s really easy to do.

The DeFi bible is now AVAILABLE TO BUY ON AMAZON!

Buy your copy of ‘The Wall Street Era is Over: The Investor’s Guide to Cryptocurrency and DeFi, the Decentralized Finance Revolution’ now!

And just one more important thing before you go…

We will be announcing some exclusive giveaways related to the book through our social media channels in the coming days so, not to miss out, follow us here.

Solana Network Ultimate Yield Farming Guide [Infographics]

Fantom Network Ultimate Yield Farming Guide [Infographics]

Huobi ECO Chain Ultimate Guide for Yield Farming

Polygon Network Ultimate Guide for Yield Farming

Binance Chain Ultimate Guide for Yield Farming

And join us on twitter and telegram!

Good luck in farming!

The end of May brought important updates across...

The start of May was filled with key updates and powerful...

The second half of April brought a lot of...

April started with innovation, milestones, and new...

March was a busy and impactful month for the De.Fi Ecosystem. We launched a ...

February was filled with major updates, partnerships, and...

© De.Fi. All rights reserved.