De.Fi: The Best Alternative to Zapper

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

Tezos blockchain has implemented a very interesting architecture that enables the network to perform self-amendment updates which in turn prevent all network participants from going through the hard-forks. The ecosystem also introduces verifiable smart contracts, a new programming language called Michelson that prevents a range of exploits, and a new block validation paradigm.

These technological advancements have laid a strong foundation to run a successful ICO round back in 2017 that has allowed the project founders Kathleen and Arthur Breitman to raise an astonishing $232 million. Tezos has gained very strong community support by conducting different initiatives and meetups across countries where top bakers(validators) reside.

The flexible network capabilities played a crucial role in making Tezos one of the most popular blockchain platforms on the market. In this guide, you will discover what services can be used to profit off of the yield farming and staking operations, and also you will understand what technical aspects make the network unique.

What is the Tezos Network?

The Tezos Network Ecosystem

The Tezos Network Innovations: Self-Amendment Ledger

Tezos Wallets

How can I transfer funds from an exchange to a Tezos wallet?

Tezos-Ethereum Bridge

Staking on Tezos/Delegating on Tezos using Temple Wallet

Staking on Tezos/Delegating on Tezos using other solutions

Yield Farming On Tezos

Should I Use Tezos Network For Yield Farming?

Tezos blockchain is based on the Liquid-Proof-of-Stake (LPOS) consensus algorithm with only a limited number of network validators called Bakers that can produce blocks. Most blockchain networks strive to increase their transaction throughput, but there are many more important network characteristics that could drive the adoption of the network.

Tezos blockchain provides a very modest 220 TPS throughput which is only 3 times faster than the Ethereum network, but at the same time, it offers great benefits in other areas, for example, self-amendment updates that prevent the network from hard-forks. Tezos introduces a new programming language for smart contracts development called Michelson, which allows formal verification of the Tezos smart contracts or, simply, it helps developers to review code transparently. It also helps developers to write more robust code that mitigates risks associated with vulnerabilities that plagued the Ethereum network.

The ecosystem gets heavily supported by the Tezos Foundation, which provides financial incentives for developers and teams who contribute to the development of the network. Tezos network provides a robust and stable infrastructure for testing and further development of financial solutions that move the network forward.

As it was mentioned earlier, the network is based on the LPoS consensus mechanism where users must vote/stake for a specific baker (validator) in order to get rewards, and also ensure the security of the network. Usually, users tend to choose bakers who make significant contributions to the network, and also in some ways, users try to spread their votes in order to avoid network centralization.

The current Tezos inflation is around 5% and users get rewarded with tezzies (XTZ) coins for voting. One of the most interesting implementations in the protocol is the possibility to use staked XTZ, where in other networks staked tokens get locked. Around 400 bakers are responsible for creating and validating new blocks, and only 1 baker is randomly chosen to create a block, and the other 32 randomly chosen bakers to validate that block.

Many blockchain users got used to frequent network hard forks, which are often provoked by updates that one majority tries to enforce over a minority. In these situations, the community gets divided and another chain is being created to support the initial idea. Tezos ecosystem easily prevents that by implementing a voting and updating system that is gradual and allows all network participants to decide whether or not they want to make a specific update.

Tezos introduces a very flexible model of ledger development, that implies a three steps process:

Once a developer completes writing the software, the network participants review the code, vote for it, and if it is good enough it gets moved to the Testnet for further testing. Network heavily relies on Bakers, who get actively involved in further voting, testing, and software release to the mainnet.

There are numerous wallets created for the Tezos ecosystem, but in this guide, we will concentrate mainly on those that can be used to connect to DeFi services. Here’s a list of such wallets:

Browser Extension Wallets:

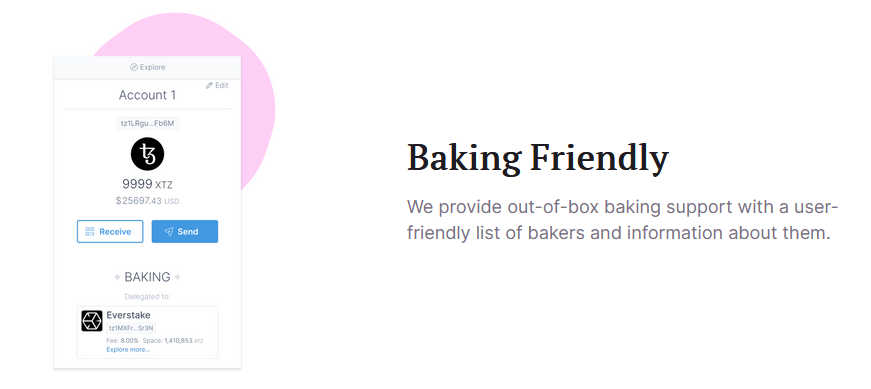

Temple Wallet is a lightweight browser extension that allows a user to interact with DeFi services, hold cryptocurrency and delegate their XTZ easily to bakers. Created by a team of developers called Madfish Solutions.

Spire Wallet is a browser extension that must be paired with desktop, mobile or hardware wallets such as Ledger in order to use the private key for further interaction with the blockchain and DeFi services. Created and maintained by AirGap.

Desktop Wallet:

Galleon wallet is one of the most advanced Tezos wallets available for Windows, Linux, and macOS, it supports hardware signing and interaction with DeFi services. Created and maintained by Cryptonomic Tech.

Web Wallet:

Kukai is a web-based app that can be used to create Tezos wallets, and also it supports hardware signing via Ledger. Created in 2018 by a former developer at Tezos.

Temple Wallet was taken as an example. The wallet itself doesn’t have a built-in feature to get XTZ tokens. Users will need to buy the tokens on an external exchange, and send them directly to the wallet account.

Once you have your funds on the exchange, click on the ‘Receive’ button directly in the wallet and copy your address.

Now you can use the copied address on the exchange to send XTZ to your wallet.

The Wrap Protocol, released not so long ago by Bender Labs, fulfills the mission of interconnecting two blockchains by allowing for Ethereum-based ERC-20 and ERC-721 tokens to be made Tezos compatible. The Wrap Protocol wraps Ethereum-based tokens in the Tezos FA2 token standard, meaning they can be used as one-to-one representations without technical difficulties or price differences.

In order to wrap the tokens and allow for cross-blockchain activity, users can use this website (https://app.tzwrap.com/wrap).

Tezos delegation process is pretty straightforward and doesn’t require any prior knowledge of blockchain. We chose Temple Wallet as our main example that will be used further to describe all necessary steps to stake on Tezos and yield farm.

Once you have installed the Temple Wallet browser extension, make sure that you have saved your seed phrase in a safe place, because if you lose access to your wallet you can restore it simply by entering it into the app. It is important to emphasize that there’s no minimum staking amount, so a user can delegate even 1 XTZ to a baker.

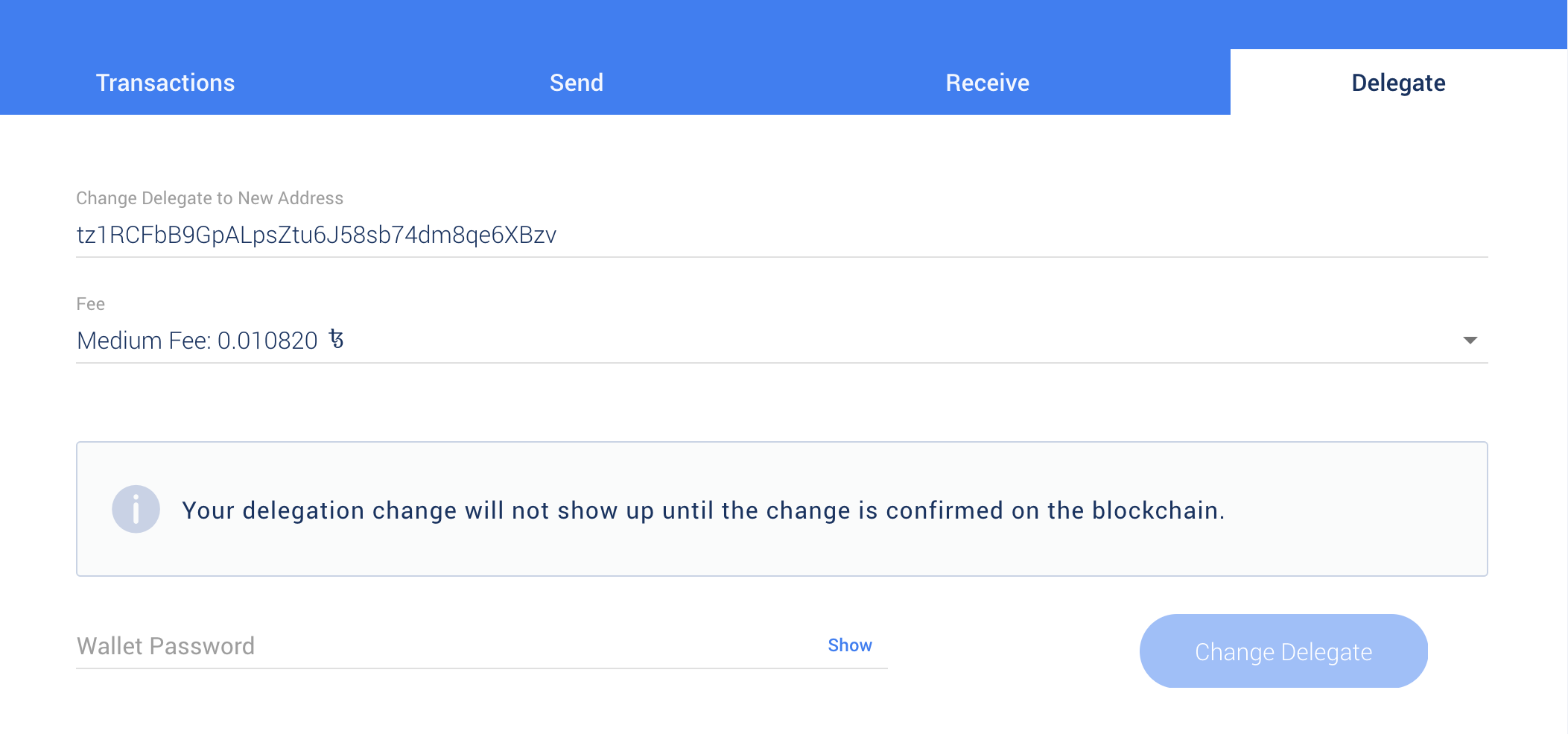

In the wallet choose the Delegation option, then click on the ‘Delegate Now’ button, and then choose the desired Baker from the list. Make sure that you choose a reliable baker that won’t be missing any blocks, because otherwise, it may impact your rewards negatively. Also, make sure that you choose a baker that has an appropriate commission that it takes.

Go through all the steps and confirm your operation. Rewards are distributed after 8 cycles (2.8 days per cycle), so in general, it takes around 23 days for a new delegate to receive rewards. Tezos staking complete.

Apart from using the aforementioned Temple Wallet to delegate your stake to a baker, there are also other options with such functionality, such as Stakewith.us, or Staked.us. Lower, you can find a few instructions on how its done on Staked.us.

If you store XTZ on a Ledger, stake here: https://staked.us/v/staketezos

Otherwise:

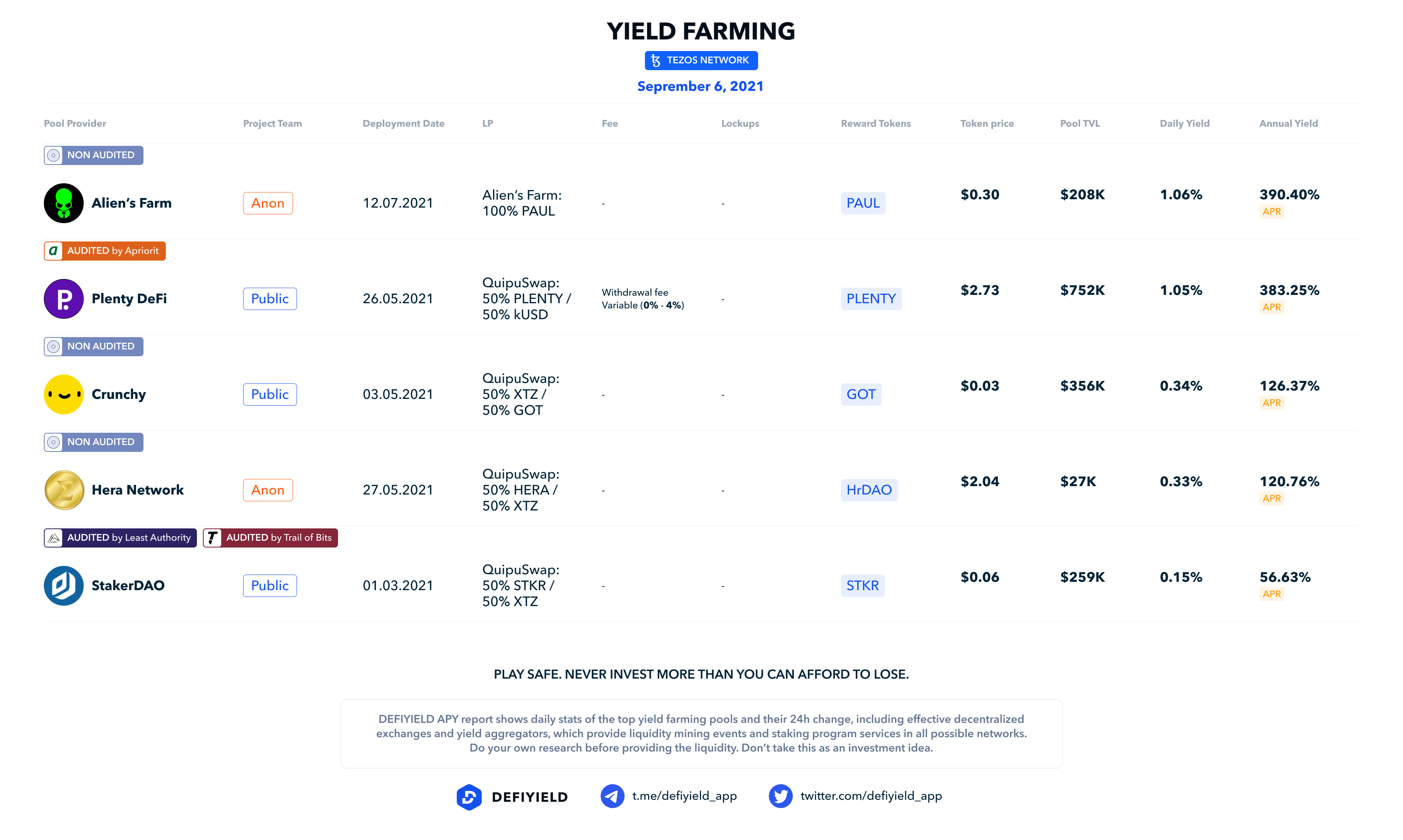

Farming is a pretty straightforward process, but it requires the Liquidity Provider tokens as well as XTZ to enter into a specific pool. In this section, we will mainly concentrate on the https://crunchy.network service and XTZ/CRUNCH pair provided there. You are free to choose any other pair that may have an even higher APY(Annual Percentage Yield).

Now you have 5 XTZ and 230 CRUNCH in your wallet. In order to use the maximum amount of available assets, you must enter the maximum amount of XTZ, and the amount of CRUNCH will be calculated automatically. This principle applies to all other LP pools.

Go through all the necessary steps and confirm your operation.

It can be definitely said that the Tezos network has secure smart contracts that can get easily verified by developers compared to Ethereum network contracts. As it was mentioned previously, the Tezos network uses the Michelson programming language that allows formal verification of smart contracts, hence developers can easily check all code and understand whether or not it has vulnerabilities. It is a completely different situation for the Ethereum network, where projects often conduct Rug Pulls and carry away huge amounts of digital assets.

In some ways, the Tezos platform is more stable and maintained, since standards and instruments are more robust. Is Tezos better than Ethereum? Well, maybe the Tezos network doesn’t have so many DeFi services as opposed to Ethereum, but the quality in some ways is higher. The Tezos ecosystem is definitely good for risk diversification, and yield farming pools provide good APY in general. This said we wouldn’t discourage anyone from earning passive income with Tezos, give it a try and let us know how it went.

Here you can check yield farming opportunities on Tezos: https://de.fi/explore/network/tezos

Solana Network Ultimate Yield Farming Guide [Infographics]

Fantom Network Ultimate Yield Farming Guide [Infographics]

Huobi ECO Chain Ultimate Guide for Yield Farming

Polygon Network Ultimate Guide for Yield Farming

Binance Chain Ultimate Guide for Yield Farming

EOS Ultimate Yield Farming Guide

And join us on Twitter and Telegram!

Good luck in farming!

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

As the crypto bull market heats up, more investors seek to navigate the burgeoning world of decentralized finance (DeFi).

When engaging with decentralized finance (DeFi), investors often face the challenge of managing investments, tracking yields, and ensuring they keep all their assets safe.

January 2024 was an incredibly important month for us. We achieved significant results and made remarkable progress.

With new crypto ecosystems popping up on a regular basis, the integration of different blockchain networks with popular wallets is a key narrative moving into the next crypto cycle.

This month, we are proud to announce that De.Fi has secured investments from the first BTC ETF provider. We're seeing a huge spike in mentions and social interest in De.Fi and $DEFI token right before the listing.

© De.Fi. All rights reserved.