De.Fi: The Best Alternative to Zapper

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

Diving deep into how Pancake Bunny changed their code according to the suggestions I made. Not in an easy way. See for yourself.

Check out our book about DeFi on Amazon!

In the middle of December, I picked the Pancake Bunny project for a regular smart contract security analysis to inform the community about possible issues and risks existing in the code.

As a reminder, my goal is to make a change in the yield farming industry by a) encouraging suspicious projects for improvements; b) informing the community what to be aware of. You can check the audits I made previously on my website.

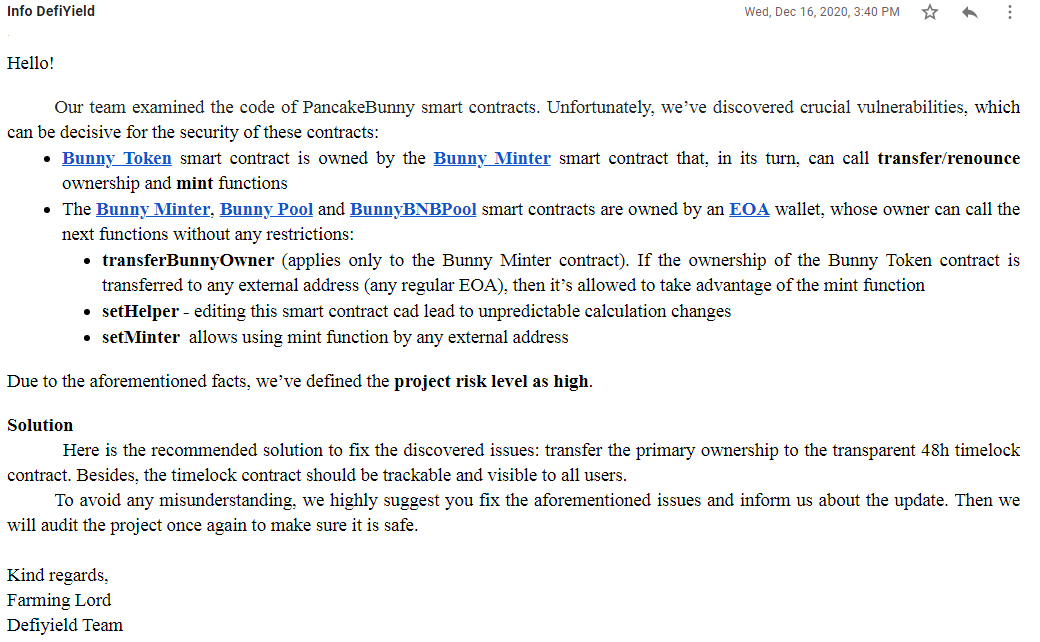

In short, I discovered multiple issues while performing the review. Such as:

Taking all the aforementioned facts into account, I estimated the yield farming risk as high. This was an objective assessment, no doubts.

However, the project risk status could be easily switched to low, if necessary changes would be implemented. Namely, I suggested introducing the Timelock contract with a sufficient delay (at least 48h) and a monitoring mechanism.

I enthusiastically composed a detailed email providing the list of issues I discovered, along with the clear steps on how to transform the smart contracts to make the project safer. Then I sent it to the Bunny team.

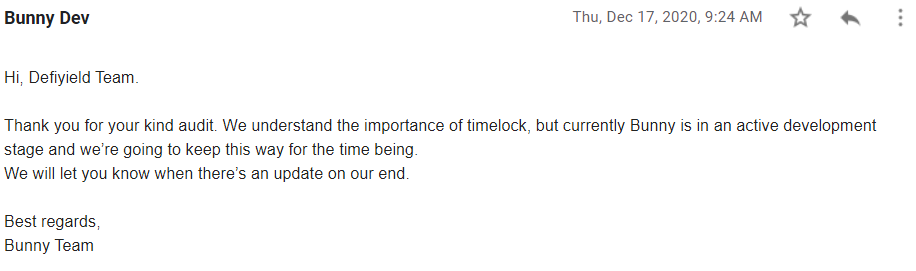

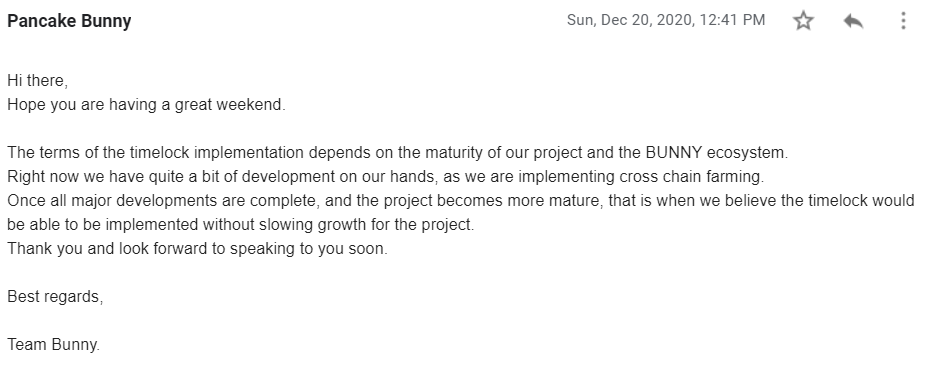

Frankly speaking, as my previous experience shows, I sincerely believed that they would follow my advice and make the changes shortly. However, my expectations didn’t come true as long as the next day I received this discouraging answer:

I bet they pretended to not understand the importance of timelock in the early development stage. The thing is, the priority should be to make the project safer and more reliable and not to create new features. The ‘active development stage’ can hardly count as an excuse. The project is worth nothing if its risk level is high for its investors. Any junior developer or manager knows that.

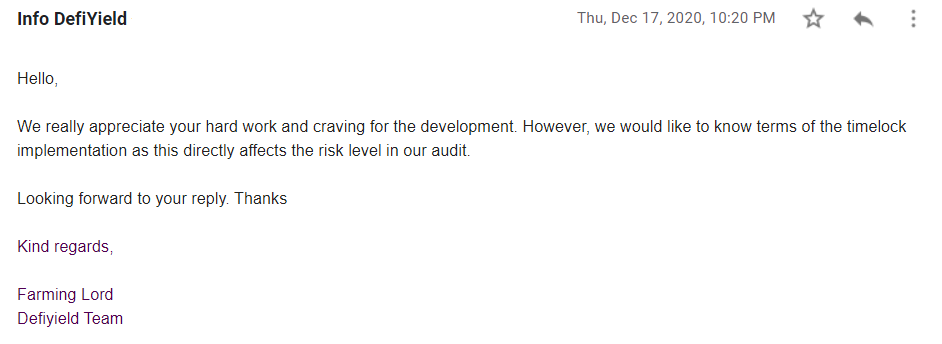

I did my best to convince them to apply the Timelock ASAP.

However, the Bunny team took a different path.

Once again, I tried to change their mind by providing real examples of how other projects executed the necessary changes and reduced the risk. But it didn’t help. Still, no actions were taken.

If you wanna stay safe and be up to date — subscribe to our newsletter! We will send you our DeFi Security Handbook straightaway. In the ebook we explain how to stay safe, what are we paying attention to while auditing projects and what should you do to not get REKT. You can expect insights, interesting content and updates from us.

Consequently, the Bunny’s inertia made me publish the warning alert on social media along with the detailed audit to shed light on the threat. Whatever the project was saying, I needed to alarm people of the existing issues:

/ [https://archive.vn/WzwO8](https://archive.vn/WzwO8)](https://de.fi/blog/wp-content/uploads/2023/06/1M1dl2-zS62-bq01ryX5pw.png)

Instead of providing the reasons and explanations, the Bunny team removed their Telegram account (the main communication channel), baffling the users.

I decided to set up a Telegram group for Bunny users to discuss the situation internally and avoid any FUD in some way. To my surprise, it was joined by dozens of users.

[ ](https://twitter.com/defiyield_app/status/1343344388928368650)/ [https://archive.is/xW5Xn](https://archive.is/xW5Xn)](https://de.fi/blog/wp-content/uploads/2023/06/17unSBRHdO3qSZ-G0oAGaug.png)

I am absolutely sure they were about to rug pull but then realized that the funds might be frozen by BSC. No other adequate explanation if only their Telegram account could be deleted ‘out of nowhere’ as they stated. Funny! I don’t believe their account was hacked indeed.

Check out this screen:

/ [https://archive.vn/rPBGQ](https://archive.vn/rPBGQ)](https://de.fi/blog/wp-content/uploads/2023/06/1UpKjOu1IkM0Bjofj98Alxg.png)

There was no other way for the Bunny team but to implement the required changes to reanimate the project and whiten its reputation.

Thus, the Timelock contract was added. However, only a 24h delay was set, instead of the recommended 48h.

/ [https://archive.vn/sEuuC](https://archive.vn/sEuuC)](https://de.fi/blog/wp-content/uploads/2023/06/1899URRU_zYw8goRnrQafbQ.png)

Of course, it’s better than nothing, however, the significant risk still exists for the users as far as the Timelock delay isn’t as long as needed. Why? All of the events should be manually monitored on a daily basis. They didn’t take care of a mechanism (a Telegram bot, for instance) to keep their users informed and up to date concerning changes proceeded under Timelock.

Thus, the risk level stated in my audit could be decreased only to medium.

My efforts were not in vain, fortunately. Even though the Bunny team had the potential to instantly decrease the risk level of their smart contracts from high to low, achieving the medium level is a good result seeing that their team initially rejected my requests.

Further on, I will continue looking for such projects and trying to have the devs update their projects and improve safety. I truly believe that by calling out the risks the industry can improve for the better.

Don’t trust — verify. Always.

Check out other articles from the Saga series:

P.S. I have a constantly updating list of projects to audit, so if you have any suggestions, make sure to let me know through any of the outlets:

Solana Network Ultimate Yield Farming Guide [Infographics]

Fantom Network Ultimate Yield Farming Guide [Infographics]

Huobi ECO Chain Ultimate Guide for Yield Farming

Polygon Network Ultimate Guide for Yield Farming

Binance Chain Ultimate Guide for Yield Farming

And join us on twitter and telegram!

Good luck in farming!

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

As the crypto bull market heats up, more investors seek to navigate the burgeoning world of decentralized finance (DeFi).

When engaging with decentralized finance (DeFi), investors often face the challenge of managing investments, tracking yields, and ensuring they keep all their assets safe.

January 2024 was an incredibly important month for us. We achieved significant results and made remarkable progress.

With new crypto ecosystems popping up on a regular basis, the integration of different blockchain networks with popular wallets is a key narrative moving into the next crypto cycle.

This month, we are proud to announce that De.Fi has secured investments from the first BTC ETF provider. We're seeing a huge spike in mentions and social interest in De.Fi and $DEFI token right before the listing.

© De.Fi. All rights reserved.