De.Fi: The Best Alternative to Zapper

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

Nice to see you back, farmers!

I think that the new year opens new horizons! Thus, in the 1st half of January, I worked intensively on both De.Fi.Info and the cross-chain Investing Dashboard.

I encourage you to get familiar with the recent changes to stay up to date.

Take a look at the **De.Fi 2/2 December Updates**

These past few weeks, I have introduced lots of updates not only to the De.Fi Info webpage but also to the cross-chain Investing Dashboard. The dashboard is currently under active development: much has been done, yet I still have a lot of work ahead.

Want to know more about Decentralized Finance? Everything you need to know is in our book! Available NOW on Amazon!

However, the progress is moving by leaps and bounds. So stay tuned for the news.

P.S. If you do not want to miss any new features, make sure you’ve joined my Telegram group.

The UI and UX for both the De.Fi.Info desktop and mobile versions have been refined.

As you know, every detail matters. So, I strive to develop the application working as smoothly as possible for you to enjoy it.

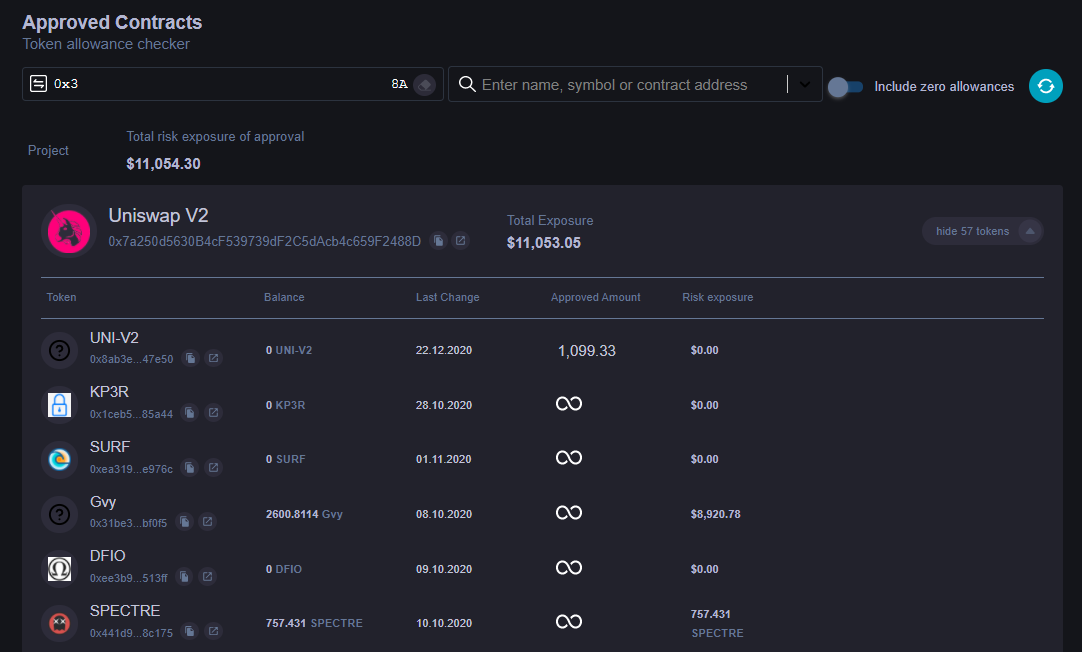

I also improved the Approved Contracts tool by adding the risk exposure amount of each contract and token. Essentially, you can track how many tokens and how much USD are at risk according to each contract.

On this page, you can review the detailed info related to each smart contract that is allowed to spend your tokens or place any changes. With this tool, you are able to decline a contract/token completely or update the number of tokens allowed to be spent by a particular app. It is totally up to you.

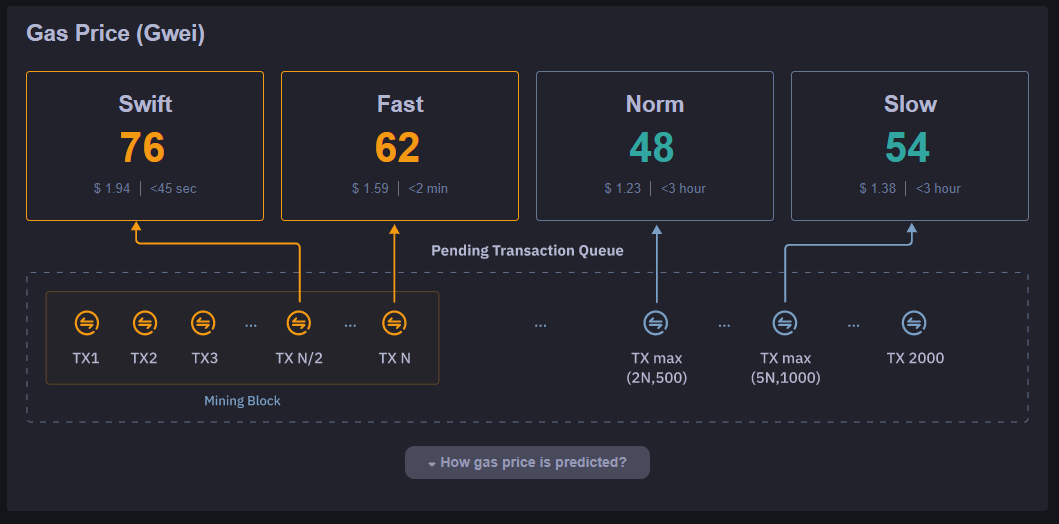

The Gas Tracker tool has been radically redesigned. Look how cool it looks now!

I decided to develop an all-encompassing Gas Tracker tool providing all the necessary information and instruments you may need while estimating, calculating and tracking the gas price. Take a look at the list of new options:

The Gas Price section allows you to get detailed info about how much time a transaction execution can take depending on fee costs.

Note there are four different speed options — Swift, Fast, Norm and Slow. You can rely on the estimated duration of the transaction execution.

One more new feature called Gas Price Estimator provides the possibility to forecast how much time the transaction processing will take depending on the gas price you pay. Just drag the slider and get the result.

Another new option that I developed is Gas Internal. I’m sure it will be enjoyed by statistics fans. Here you can see the real-time gas use chart and the number of transactions depending on the price of paid gas.

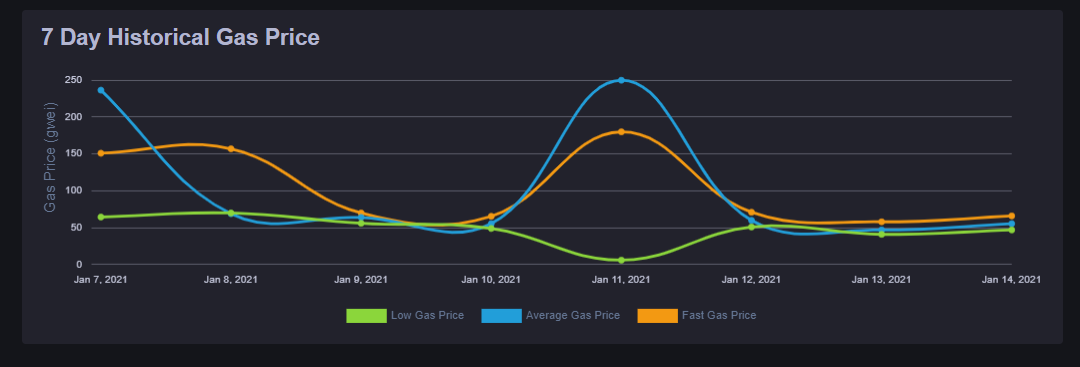

Another new feature represents the 7-day period historical gas price with three curves — Low, Average, and Fast gas costs.

Inspect how the gas price fluctuates within a week.

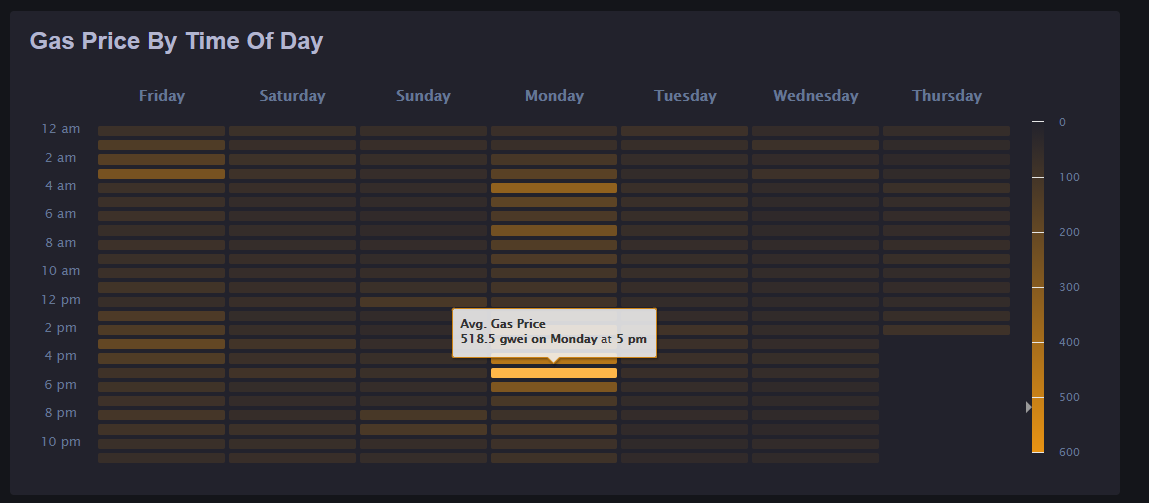

Discover how exactly gas changed during each day within a week with the Gas Price By Time Of Day feature.

Hover over any cell and get info on what the average gas price was at a specific time of the day. For instance, here you can see the level of the average gas fee at 5 pm on Monday.

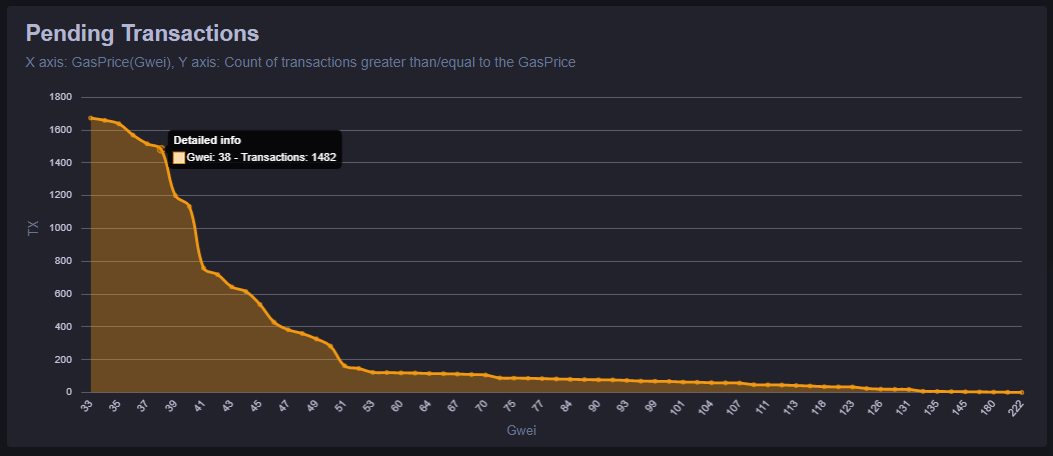

Here is another chart with information on the number of pending transactions and gas prices. In the example, there are 1482 pending transactions with an average price of 38 Gwei.

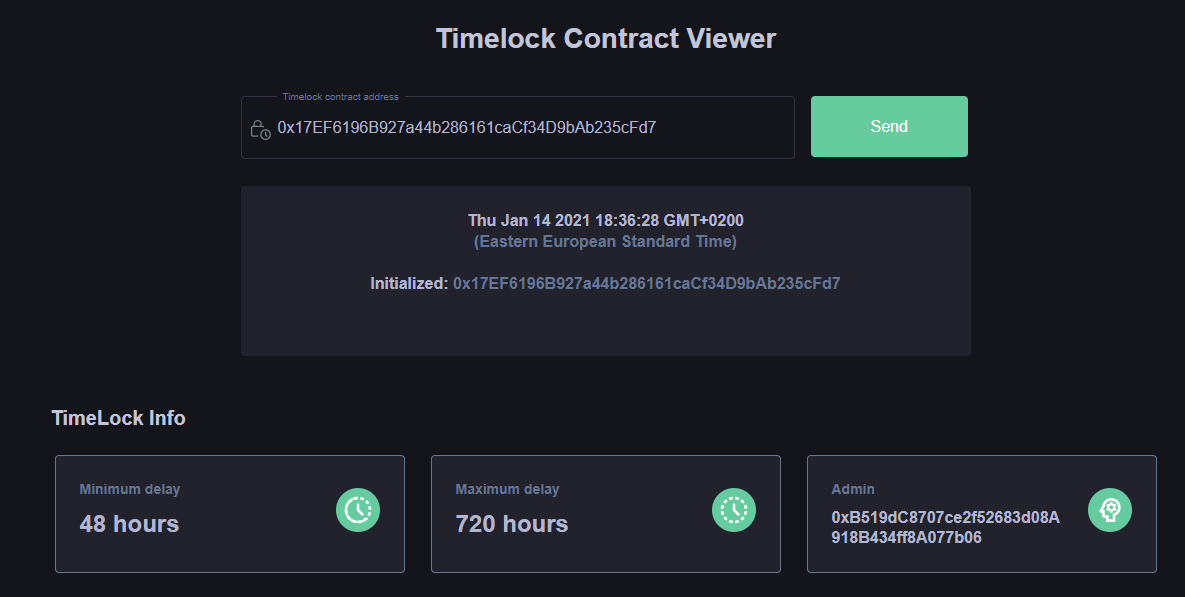

From now on, Timelock Contract Viewer also supports Binance Smart Chain. Thus, you can get info related to any Timelock contract published on BSC, such as Minimum&Maximum delays, Admin address, transactions, etc.

Don’t know how to start? Merely go to the Timelock Contract Viewer tool, enter Timelock address (Ethereum or BSC), and hit Send. Then, just review the details. Easy-peasy.

To view the BSC-related info, conduct some adjustments for the BSC network.

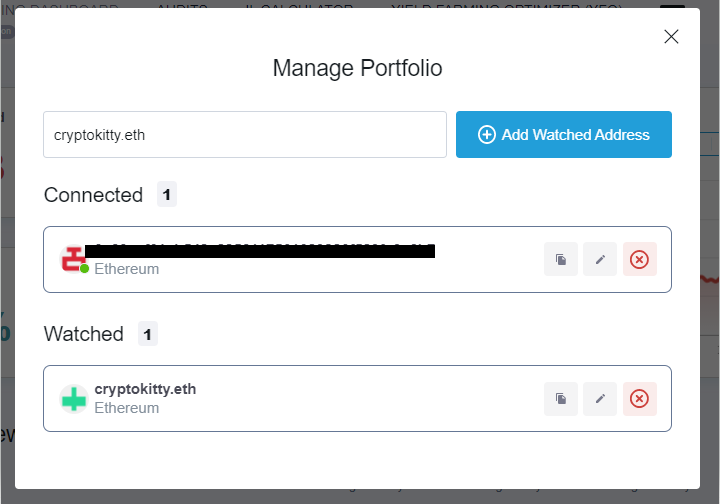

I added one more useful feature to the Portfolio tool. From now on, you can add Ethereum Name Service (ENS) domains to the Portfolio watched addresses, for instance, cryptokitty.eth.

You can use the Ethereum lookup to find out the domain names and associated applications.

As usual, I chase scam projects to kick them out of yield farming.

This time, I discovered that Xdef finance, Dasis cash and Mocha Set Dollar have rug pulled. Consequently, all of them were added to the Yield Farming Scam Database.

Stay out of the fraudsters!

Algorithmic stablecoins have been a large trend recently. So, I didn’t ignore this topic and dived deeper to get the whole picture. I published a complete guide answering lots of arising questions, such as how to invest in them:

](https://de.fi/blog/wp-content/uploads/2023/06/0Q1_KzHvN68KN7k52.png)

Have you already read the Pancake Bunny Saga: Revealing All the Details of Tough Transformation? I published this post a few days ago. It is an exciting story about how I made the Pancake Bunny team fix certain high-risk issues of their smart contracts and transform the project for the better.

Take a look at the article to get the complete picture.

I emphasize that I’m always open to new horizons and partnerships. You can contact me via email info@de.fi 😉

Let me remind you that there is an awesome tool that allows you to leave any feedback, send any suggestions, propose new features to be designed and request audits. All of it can be done through the Roadmap & Feedback tool.

Don’t hesitate to contribute! Looking forward to hearing from you.

🧑🌾 Join the community of farmers

Be among the first to know about the updates — subscribe to the newsletter and follow me on socials.

Join the De.Fi Telegram channel

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

As the crypto bull market heats up, more investors seek to navigate the burgeoning world of decentralized finance (DeFi).

When engaging with decentralized finance (DeFi), investors often face the challenge of managing investments, tracking yields, and ensuring they keep all their assets safe.

January 2024 was an incredibly important month for us. We achieved significant results and made remarkable progress.

With new crypto ecosystems popping up on a regular basis, the integration of different blockchain networks with popular wallets is a key narrative moving into the next crypto cycle.

This month, we are proud to announce that De.Fi has secured investments from the first BTC ETF provider. We're seeing a huge spike in mentions and social interest in De.Fi and $DEFI token right before the listing.

© De.Fi. All rights reserved.